Cryptocurrency Market Update: A Volatile Landscape

This week has seen a notable shake-up in the cryptocurrency market, with the total market capitalization dipping by 4.1% to settle at $3.33 trillion. Amidst this downward trend, daily trading volume has surged, reaching an impressive $142.2 billion. The terrain remains rocky, yet several significant cryptocurrencies are showing surprising resilience. As investors try to navigate these turbulent waters, observations indicate a blend of profit-taking, speculative trading, and cautious optimism ahead.

TL;DR: What You Need to Know

- The overall crypto market cap has fallen by 4.1% to $3.33 trillion.

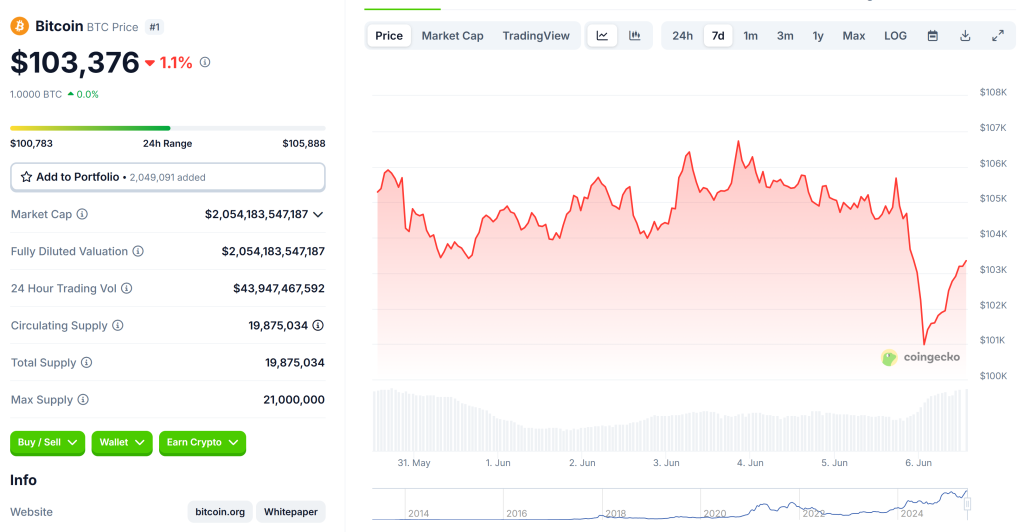

- Bitcoin (BTC) maintains its position above $103,000 despite a recent all-time high of $111,800.

- Profit realization by long-term holders is limiting short-term price gains for BTC.

- Smaller market cap coins like KILL BIG BEAUTIFUL and VICE are seeing heightened speculative interest.

- Institutional inflows and potential ETF approvals may drive BTC to $115,000 by early July.

- The upcoming U.S. jobs report is poised to impact BTC’s movements, with key support levels around $95,000 to $97,000.

Current Leaders and Underperformers

As we dive deeper into specific cryptocurrencies, Bitcoin (BTC) is currently priced at approximately $103,188, holding steady for the day. On the flip side, Ethereum (ETH) has faced a tougher day, enduring a decline of 5.8% and now trading at $2,455.79.

XRP is maintaining a slight upward trend at $2.13, while Tether (USDT) and USD Coin (USDC) are firmly stationed at $1. However, Solana (SOL) has seen better days with a 3.5% dip, now priced at $147.26, while Dogecoin (DOGE) has faltered even more dramatically, down 7.2% to $0.175.

In a surprising turn, smaller cap tokens such as KILL BIG BEAUTIFUL have skyrocketed by 168.5%, with VICE and GIZA trailing close behind at gains of 35% and 17.7%, respectively. This surge reflects an intriguing trend of increased speculation in lesser-known coins.

“BTC has broken above the short-term holder realized price. If history repeats… Bitcoin is about to explode!” — @misterrcrypto, June 5, 2025

Market Dynamics: Profit-Taking and Price Action

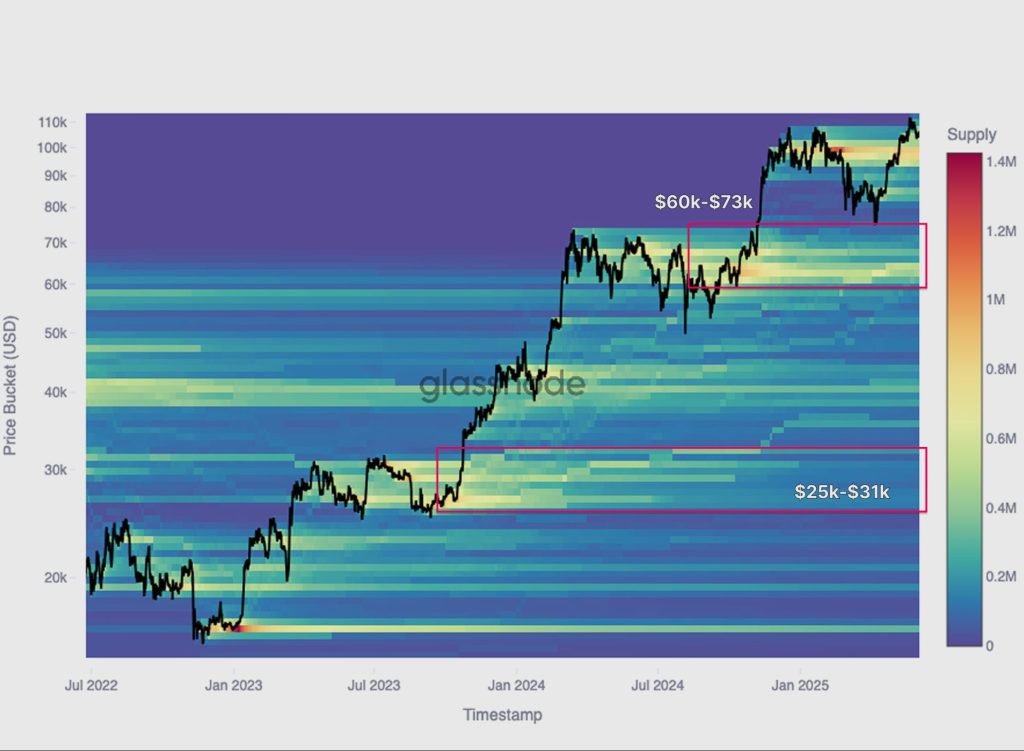

Bitcoin’s recent trajectory has experienced significant fluctuations, skyrocketing to a peak of $111.8K before pulling back to around $103.2K. This correction comes as long-term holders begin to liquidate positions, as revealed by leading insights from Glassnode. The recent rally, fueled primarily by spot trading, has established key support levels now oscillating between $81K and $104K. However, the increased selling from seasoned investors poses a formidable barrier to further upward momentum.

Historical data indicates that many previous accumulation zones have transformed into distribution zones, specifically those around the $25K-$31K and $60K-$73K marks. This shift indicates that long-term holders are not just taking profits but also redefining the market structure, adding selling pressure that jeopardizes Bitcoin’s short-term prospects.

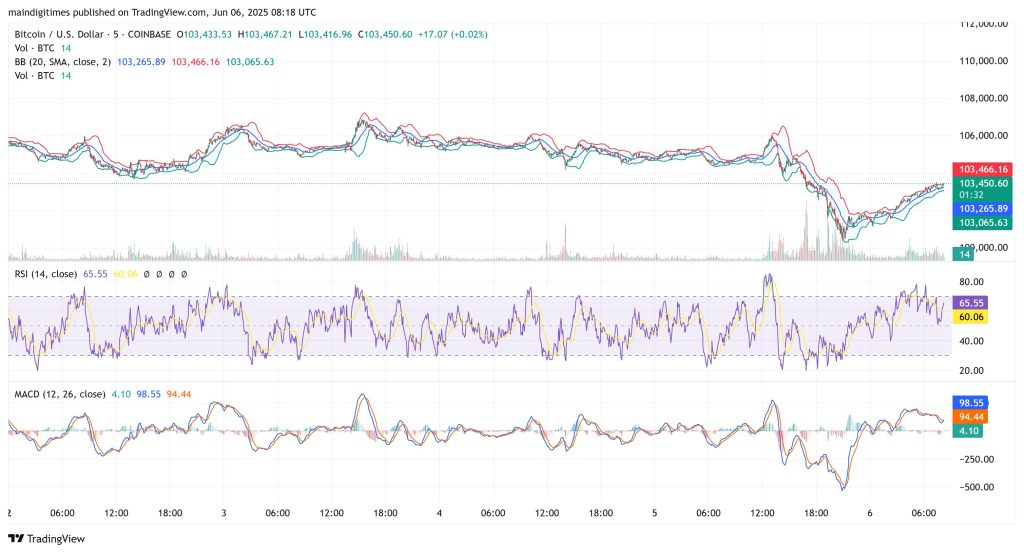

Cost basis models now highlight immediate support levels around $103.7K and $95.6K, while resistance is pegged at $114.8K. Understanding these thresholds is essential for market watchers; a break through these levels could either signal a resurgence of momentum or confirmation of stalling sentiment.

What Lies Ahead: Predictions and Potential Events

Bitcoin is now trading at $103,450, having briefly peaked at $103,467 during the day. Following its recent highs, it is currently down about 7.5%. Interestingly, over the past week, BTC has experienced a decline of roughly 3%, though a monthly gain of around 8% still offers a glimmer of hope.

Looking toward the horizon, analysts at Bitfinex speculate that Bitcoin could surge toward $115,000 or above by early July. Key drivers for this potential upward movement include institutional interest, possible ETF inflows, and broader macroeconomic trends. The upcoming U.S. jobs report may enhance or hinder BTC’s trajectory, especially if it strengthens expectations for Federal Reserve rate cuts, which could stimulate interest in riskier assets like Bitcoin.

🎯 SCENARIO FRAMEWORK: June 2025 BTC Forecast 🟢 Bullish Breakout (Probability: 79%) • Range: $112K → $126K • Triggers: • Trump–Musk détente formalized as strategic alliance • U.S. jobs report confirms soft-landing illusion breaking • ETF inflows resume post-volatility flush… — @SightBringer

Conclusion: A Time for Vigilance and Preparedness

As Bitcoin hovers near the $104,000 mark, short-term traders must brace for the unpredictable nature of the market. Should the jobs report show unexpected strength, BTC might retreat to around $102,000 or lower. However, the financial landscape remains complex, shaped by both institutional factors and evolving market sentiment. As the crypto community holds its collective breath, the coming weeks could set the stage for a sizable push forward or deeper corrections. What are your thoughts? Are you preparing for the next wave in the crypto fold?