Explosive Growth in Tokenized Real-World Assets: A 2025 Landscape

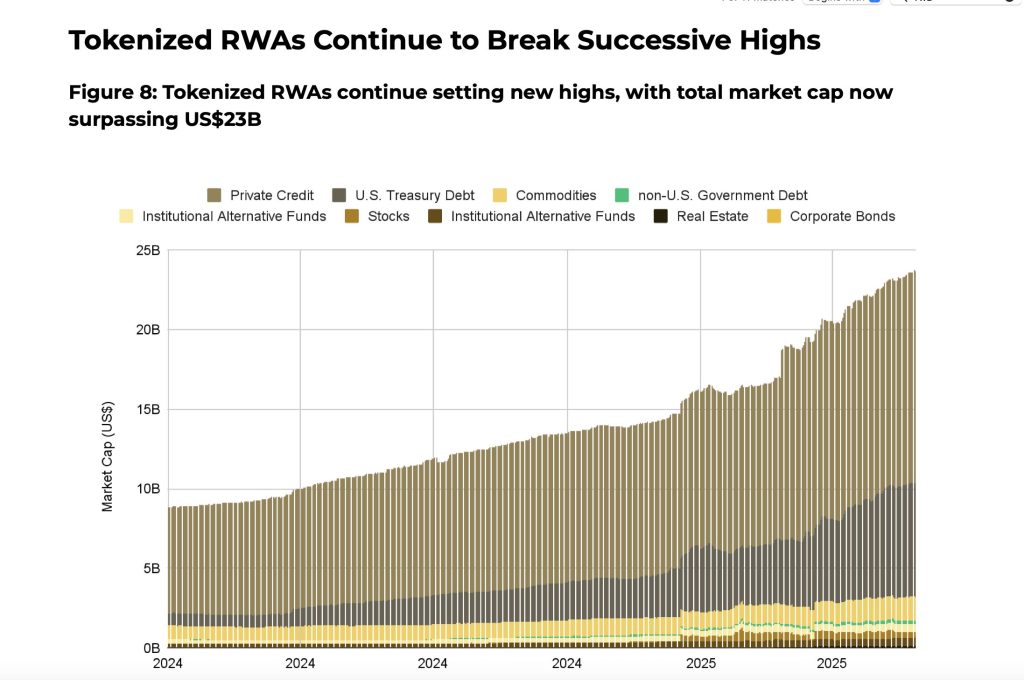

The world of cryptocurrency is experiencing a remarkable transformation, especially in the realm of tokenized real-world assets (RWAs). According to a recent report from Binance Research, authored by the team of Moulik Nagesh, Joshua Wong, Michael JJ, and Asher Lin Jiayong, the RWA market has skyrocketed from $8.6 billion to an astonishing $23 billion in just the first half of 2025. This represents a staggering increase of 260%, showcasing a tectonic shift in how traditional financial assets are being transitioned onto the blockchain.

*The RWA market has exploded in 2025, reshaping the financial landscape.*

Tokenized Private Credit: The Game Changer

Leading this remarkable expansion is the asset class of tokenized private credit, which has secured a commanding position, accounting for 58% of the total RWA market. In a surprising twist, it has even outpaced tokenized U.S. Treasuries, which hold a substantial 34% market share. The growing allure of private credit comes from its impressive yield potential and increasing demand from decentralized finance (DeFi) investors and institutions, who are eagerly seeking innovative alternatives to conventional lending frameworks.

Time to look at June’s market insights!

Discover the current market landscape and key insights on:

🔸 Spot ETF Flows

🔸 Corporate BTC Treasuries

🔸 Sector Divergence

🔸 Tokenized RWAs…and more.

Read here ⬇️

https://t.co/XItAOGvn5O

— Binance Research (@BinanceResearch) June 5, 2025

Tradable’s Rise: Pioneering the Frontier

A significant player in the tokenized private credit arena is Tradable, a groundbreaking protocol launched on the ZKSync Era in January 2025. Tradable has already tokenized over $2 billion in assets, establishing itself as a frontrunner in bridging traditional finance (TradFi) with decentralized finance (DeFi). Its swift ascent is indicative of a strong market fit and a burgeoning investor enthusiasm for tokenized debt instruments, reflecting a growing trend towards innovative financial solutions.

The Maturation of DeFi: New Avenues of Integration

The integration of RWAs into the DeFi ecosystem marks a pivotal development in this space. The BlackRock BUIDL fund, now the largest tokenized treasury product with $2.9 billion in assets—up from just $649 million earlier this year—has made headlines with its first direct integration into DeFi through Euler Finance. This groundbreaking step allows users to lend and borrow against tokenized treasury assets, paving the way for unprecedented composability and utility in on-chain financial offerings.

Additionally, projects like Centrifuge and Securitize have recently made strides by launching tokenized funds on the Solana blockchain, collaborating with DeFi platforms like Kamino Finance. These integrations enhance liquidity and accessibility, positioning RWAs as a reliable source of yield and contributing to the evolution of DeFi from a self-contained environment into a more interconnected financial system.

The Broader Bull Market: Driving Forces Behind Growth

The remarkable growth of tokenized RWAs is not happening in isolation; it is coinciding with a broader bullish trend across the crypto markets. In May 2025, the overall cryptocurrency market surged by 10.3% amidst lingering macroeconomic uncertainties. This upswing was notably supported by a wave of net inflows totaling $5.2 billion into U.S. spot Bitcoin ETFs, marking the most robust performance since late 2024. These developments helped propel Bitcoin to new heights, nearing an all-time high of around $112,000.

Further buoying the market this year are advancements in stablecoin legislation in the U.S. and Hong Kong, alongside growing adoption by corporate treasuries. Currently, 116 public companies collectively hold over 809,000 BTC, with a cautious yet growing interest diversifying into Ethereum (ETH), Solana (SOL), and XRP. Although sectors like Gaming and Layer 2 struggled, DeFi witnessed an impressive 19% growth in May, indicating a shift of capital towards yield-bearing sectors such as RWAs.

📌 Why This Matters

The surge in tokenized RWAs represents more than just numbers; it signifies a fundamental evolution in how finance operates. By marrying traditional assets with the innovative capabilities of blockchain technology, this growth could lead to a more accessible and efficient financial system that appeals to a broader range of investors. In essence, the fusion of RWAs and DeFi could redefine the landscape of both sectors, fostering inclusivity and innovation.

🔥 Expert Opinions: Insights from Analysts

Analysts are weighing in on this rapid development, suggesting that the impressive traction of tokenized RWAs could lead to revolutionary changes in investment strategies. “The potential for RWAs to offer yields comparable to traditional investments while leveraging the decentralized ethos of blockchain is a game-changer,” says a hypothetical industry expert. “This could attract institutional money in ways we haven’t seen before.”

🚀 Future Outlook: Navigating the Road Ahead

Looking ahead, the trajectory of the RWA market appears promising. As regulations continue to evolve and investors become increasingly receptive to new financial instruments, we could see further advancements in tokenized assets. Analysts predict that the integration of RWAs into DeFi will continue to thrive, becoming a defining aspect of the financial landscape. As yields become more attractive and platforms grow in reliability, the potential for sustainable growth in both sectors seems boundless.

Conclusion: Join the Conversation

The explosive growth of tokenized real-world assets is a testament to the transformative power of blockchain technology. As we stand at the convergence of traditional finance and digital innovation, it’s an exciting time for investors and enthusiasts alike. What do you think about the future of RWAs? Will they redefine our financial systems, or will challenges ahead temper their rapid rise? Share your thoughts in the comments below!