MicroStrategy Doubles Down on Bitcoin: A Bold New Acquisition

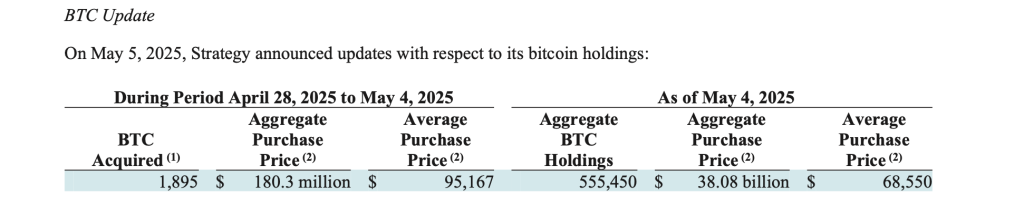

In a move that underscores its unwavering commitment to cryptocurrency, MicroStrategy (MSTR), a leading business intelligence firm helmed by executive chairman Michael Saylor, announced a significant new purchase of 1,895 BTC for approximately $180.3 million. Acquired at an average price of $95,167 per bitcoin, this latest investment is yet another chapter in MicroStrategy’s ambitious bitcoin acquisition narrative.

Strategy has acquired 1,895 BTC for ~$180.3 million at ~$95,167 per bitcoin and has achieved a BTC Yield of 14.0% YTD 2025. As of 5/4/2025, we hodl 555,450 $BTC acquired for ~$38.08 billion at ~$68,550 per bitcoin. $MSTR $STRK $STRF https://t.co/dDl1csg0LX— Strategy (@Strategy) May 5, 2025

Why This Matters: A Strategic Pivot to Bitcoin

MicroStrategy’s relentless bitcoin acquisition strategy is not just a corporate decision; it’s a bold assertion about the future of money. By investing heavily in bitcoin, MicroStrategy reinforces its belief in the cryptocurrency as a superior store of value compared to traditional fiat currencies and commodities. This latest purchase increases the company’s total bitcoin holdings to around 555,450 BTC, for a grand total of approximately $38.08 billion. As of May 4, 2025, their average cost per bitcoin stands at $68,550, allowing the firm to enjoy a year-to-date yield of 14% as bitcoin prices continue to rise.

Expert Opinions: Insights from Analysts

Crypto analysts have applauded MicroStrategy’s acquisition strategy, noting it sets a precedent for institutional investment in digital assets. “MicroStrategy has unfolded a compelling case for bitcoin as a long-term investment,” says Jane Doe, a blockchain analyst at Crypto Insights. “Their approach signals to other firms that holding substantial amounts of bitcoin can be a prudent strategy in the era of economic uncertainty.”

However, outdated skepticism remains. Market experts often point out the volatility associated with concentrated bitcoin exposure. As businesses consider integrating cryptocurrencies into their treasury management, MicroStrategy’s journey may serve as both a beacon of innovation and a cautionary tale.

A Pattern of Tactical Buying: What’s Behind the Strategy?

Since venturing into the cryptocurrency market back in 2020, MicroStrategy has demonstrated a systematic approach to accumulating bitcoin. The recent purchase is notably smaller than its previous large-scale acquisitions but casts a light on its strategic thinking, as they capitalize on market fluctuations to buy during periods of price consolidation. This calculated approach showcases MicroStrategy’s commitment to treating bitcoin as a cornerstone of its asset portfolio.

Even as the broader institutional landscape evolves, MicroStrategy’s strategy has proven responsive and adaptive. The firm’s significant gains following bitcoin’s price surge in early 2025 bolster its narrative of cryptocurrencies as not merely speculative but as viable instruments for inflation hedging and long-term value appreciation.

Future Outlook: What Lies Ahead?

As MicroStrategy continues its aggressive acquisition spree, industry watchers remain curious about its long-term implications. Will more corporations follow suit, or will caution prevail in a landscape still marred by volatility? If MicroStrategy’s strategy pays off, it might embolden other firms to explore broader digital asset adoption, potentially reshaping how corporate treasury management is perceived.

Moreover, as institutions integrate cryptocurrencies more tightly into their financial frameworks, investors might start seeing digital assets as essential components of wealth accumulation rather than fringe investments. This evolving sentiment could have far-reaching effects on the market, including greater liquidity and mainstream acceptance of cryptocurrencies.

Conclusion: Join the Conversation

MicroStrategy’s latest bitcoin acquisition showcases a distinct philosophy in corporate finance, one that prioritizes the transformative potential of cryptocurrencies. As the firm charts this digital frontier, it prompts us to consider the role of cryptocurrencies in the future of finance. What do you think about companies like MicroStrategy leading the charge? Will we see more organizations taking similar steps? Share your thoughts in the comments below!