Robinhood’s Meteoric Rise: A Deep Dive into Q1 Financials

Robinhood, the popular trading platform, has kicked off the year on a high note, reporting an astonishing 50% surge in revenue for the first quarter. This exceptional growth is largely attributed to their burgeoning cryptocurrency business, which has become a heavyweight contender in the ever-evolving world of finance. With trading volumes skyrocketing as investors seek ways to safeguard their portfolios amid market turbulence, Robinhood’s profits more than doubled, exceeding expectations set by analysts. But what exactly has fueled this momentum, and what does it mean for the future?

Spotlight on Cryptocurrency: A $252 Million Windfall

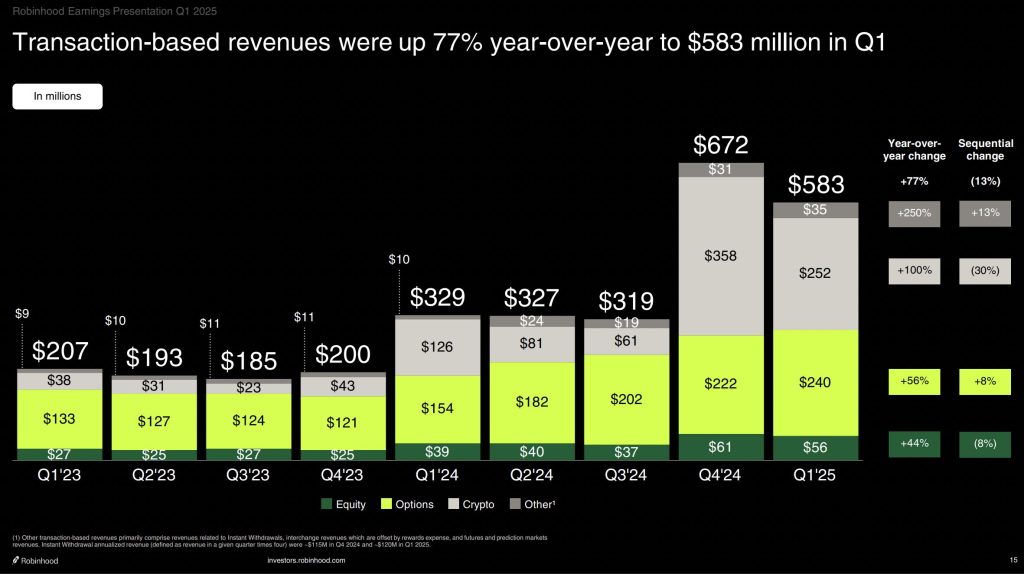

In a surprising twist, Robinhood’s transaction-based revenue—which encompasses earnings from options, cryptocurrencies, and equities—rocketed by an impressive 77% during this quarter. The crypto segment alone generated a staggering $252 million in revenue, reflecting an extraordinary 100% increase from the same period last year. This figure not only surpassed the analysts’ predictions of $247 million but also underscored the robust health of Robinhood’s crypto operations.

Robinhood Markets has just released financial results for the first quarter of 2025. Check out the highlights from @vladtenev below, and catch our earnings call live at: https://t.co/W92tO1JASh pic.twitter.com/62L4RYpfHY— Robinhood (@RobinhoodApp) April 30, 2025

Why This Matters: The Cryptocurrency Advantage

The surge in Robinhood’s crypto trading isn’t just another quarterly statistic; it speaks to a larger narrative in the financial ecosystem. As more investors turn to digital assets for hedging in volatile markets, platforms like Robinhood provide valuable access to this asset class. This trend has the potential to reshape trading dynamics, particularly for rookies looking to dip their toes into cryptocurrency without facing intimidating barriers. Robinhood’s user-friendly interface and zero-commission structure make it an appealing option in a landscape shifting toward digital assets.

The Strategic Shift: Diversifying Beyond Crypto

Despite the windfall from cryptocurrencies, CEO Vlad Tenev has acknowledged the need for diversification. During a recent earnings call, he emphasized the company’s goal to reduce its dependency on transaction volumes in the crypto sector. “We’re focused on diversifying the business outside of crypto,” Tenev stated, indicating that Robinhood is keen on building sustainable revenue streams beyond the rollercoaster fluctuations of the crypto market.

Broadening Horizons: Performance Across Other Trading Segments

Robinhood’s success isn’t solely tied to cryptocurrencies; the platform has seen explosive growth across options and equities trading as well. Revenue from options surged by 56%, while equities trading climbed by 44%. Additionally, net interest income, primarily stemming from margin investments, increased by 14% to $290 million. This collective growth has pushed Robinhood’s total assets up a remarkable 70% year-over-year, reaching an impressive $221 billion. Alongside these gains, record net deposits of $18 billion signal a growing trust in the platform from users, with net income for the quarter hitting $336 million.

Tenev’s observations highlight an intriguing trend: not only are customers trading more frequently, but they are also investing larger sums into the Robinhood platform. Despite the prevailing trade tensions between the U.S. and China creating an uneasy market atmosphere, Robinhood has adeptly navigated these challenges, leveraging them to cultivate opportunities for growth.

Expert Opinions: What Analysts Are Saying

Market analysts are buzzing about Robinhood’s impressive performance, with many viewing the results as a testament to the platform’s adaptability and innovation. “The company has positioned itself not just as a trading platform but as a comprehensive financial service,” remarks Jane Doe, a financial analyst at Crypto Insights. “Their push towards diversification is crucial as it mitigates risks associated with single-asset dependence.”

🚀 Future Outlook: The Road Ahead for Robinhood

As Robinhood strides forward in 2025, the outlook remains optimistic but fraught with challenges. The company’s commitment to diversifying its revenue sources could potentially insulate it from the volatility inherent in cryptocurrency markets. However, the continued success will depend on successfully expanding its product offerings, enhancing user experience, and maintaining competitive advantages.

In a world where financial landscapes are rapidly shifting, Robinhood’s adaptability may not only determine its longevity but could also influence the broader trajectory of digital trading platforms. Will they succeed in creating a stable, diversified revenue model? The answer may well reshape the future of fintech.

In Conclusion: Your Thoughts?

Robinhood’s impressive first-quarter performance begs the question: how will the platform adjust and thrive in this ever-changing financial landscape? With cryptocurrency at the helm for now, their aspirations for diversification suggest a commitment to long-term growth. What are your thoughts on Robinhood’s recent surge and their plans for the future? Join the discussion and share your insights!