Ethereum Surges: A Bullish Week for ETH Enthusiasts

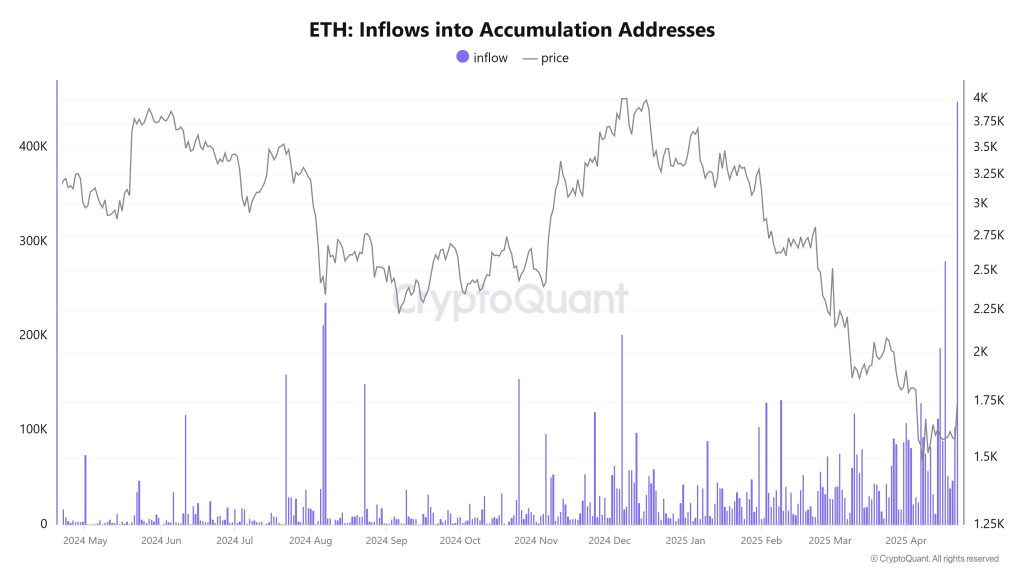

This week has been a thrilling ride for Ethereum (ETH) investors, as the cryptocurrency demonstrated impressive bullish momentum with a notable 12.11% price increase, reaching $1,803. Daily trading volumes posted a staggering $17.3 billion, highlighting strong market interest. The buzz around ETH intensified when long-term holders accumulated an astonishing 449,000 ETH in a single day—an event that marks the largest influx to accumulation addresses since 2018. This unprecedented move comes amidst an average price of $1,750, suggesting that despite existing underwater positions, investors are rallying behind Ethereum’s potential.

“$ETH ETFs Net flows = +$294.9m Highest net inflow day on record.” — #333kByJuly2025 (@CarpeNoctom) November 12, 2024

📌 Why This Matters

This surge is more than just a fleeting market trend. It represents a significant shift in sentiment. For years, Ethereum’s realized price—a metric that reflects where holders purchased their assets—lagged behind the market price. Recently, however, we’ve seen a reversal: the realized price now exceeds the market price, signaling a burgeoning belief in ETH’s long-term viability. This is a critical indicator of the growing institutional and retail confidence in Ethereum, suggesting that many investors see it not just as a cryptocurrency but a pivotal player in the evolution of decentralized finance (DeFi) and blockchain technology.

🔥 Expert Opinions

Market analysts are buzzing with potential insights. One expert observed, “The massive accumulation is a strong indicator of confidence in Ethereum’s ability to overcome current market hurdles.” This bullish sentiment is further bolstered by the growing adoption of Ethereum by institutional investors and the increasing recognition of its potential as a ‘digital oil’. While some warn of the risk of market corrections, the prevailing view suggests that with solid fundamentals, ETH is well-positioned to continue its upward trend.

🚀 Future Outlook: Is $2,000 Within Reach?

From a technical standpoint, Ethereum currently sits comfortably above the 50 EMA (Exponential Moving Average) at $1,755, reinforcing its bullish trend. Currently trading around $1,811, it is on the precipice of testing key resistance at $1,888. Analysts are eyeing this level closely; if cleared with significant volume, it could set the stage for ETH to potentially reach new highs of up to $2,035. However, a consolidation phase might also be in the cards, indicating the need for patience as traders navigate the upcoming sessions.

Ethereum’s On-Chain Activity: A Mixed Bag

While the price movement certainly excites investors, it is essential to analyze on-chain data for a holistic view. Active addresses have surged by 10%, indicating that both retail and institutional players are becoming increasingly engaged with the network—rising from 306,211 to 336,366 active addresses. However, the decentralized finance (DeFi) sector within Ethereum presents a more tempered narrative. Weekly decentralized exchange (DEX) volumes have stagnated at approximately 1.3 million transactions, which is a stark contrast to the exuberance seen during past bull runs. The ongoing lack of momentum in DeFi may keep Ethereum’s price growth tethered to broader market developments rather than a resurgence of DeFi activity.

Preparing for the Next Phase: Trading Insights

As Ethereum approaches critical resistance levels, traders should prepare for potential movements. Key setups to watch include:

- Buy breakout: Above $1,888

- Upside targets: $1,959 and $2,035

- Support levels: Watch the 50 EMA at $1,755

- Stop-loss: Set below $1,755

Bottom Line: What’s Next for Ethereum?

With Ethereum’s underlying fundamentals—growing accumulation patterns, a rise in active participation, and solid technical support—the outlook remains cautiously optimistic. If ETH can successfully navigate past the $1,888 resistance with volume, it may embark on a more significant upward trajectory. However, without confirmation of such a movement, ETH could remain trapped within its current range, making the road to $5,000 uncertain and distant.

BTC Bull Token: Staking Momentum Continues

In other developments, the Ethereum-based BTC Bull Token ($BTCBULL) is witnessing a surge of investor interest, approaching a remarkable $5 million in presale funding. Currently priced at $0.00248, potential buyers have a crucial opportunity to enter before the next price adjustment. What truly sets BTCBULL apart is its utility-focused design, offering an annual yield of 83% through staking, combined with Bitcoin-based distribution rewards, all without the usual lock-up constraints.

Presale Snapshot: A Unique Entry Point

The BTCBULL presale is nearing its final stretch. With less than $754,000 remaining until the next tier, current participants are wisely locking in their positions ahead of the anticipated price increase. Here’s a snapshot of the presale metrics as of now:

- Token Price: $0.00248

- USDT Raised: $5M out of a target of $5.74M

- Total Tokens Staked: 1,268,011,229 BTCBULL

- Annual Yield: 83% APY

- Unstaking: Anytime access

BTCBULL offers a remarkable blend of yield generation with upside potential, making it an exciting opportunity amidst the evolving landscape of meme tokens. As the presale approaches its conclusion, the next pricing phase may come sooner than anticipated, prompting savvy investors to act swiftly.

Conclusion: Join the Conversation!

As Ethereum’s story unfolds and new projects like BTCBULL emerge, the cryptocurrency landscape continues to evolve in fascinating ways. What are your thoughts on Ethereum’s recent surge? Do you believe the DeFi sector will eventually catch up? Join the discussion in the comments below and stay informed with our latest updates!