Bitcoin’s Bullish Momentum: A New Dawn Above $85,000

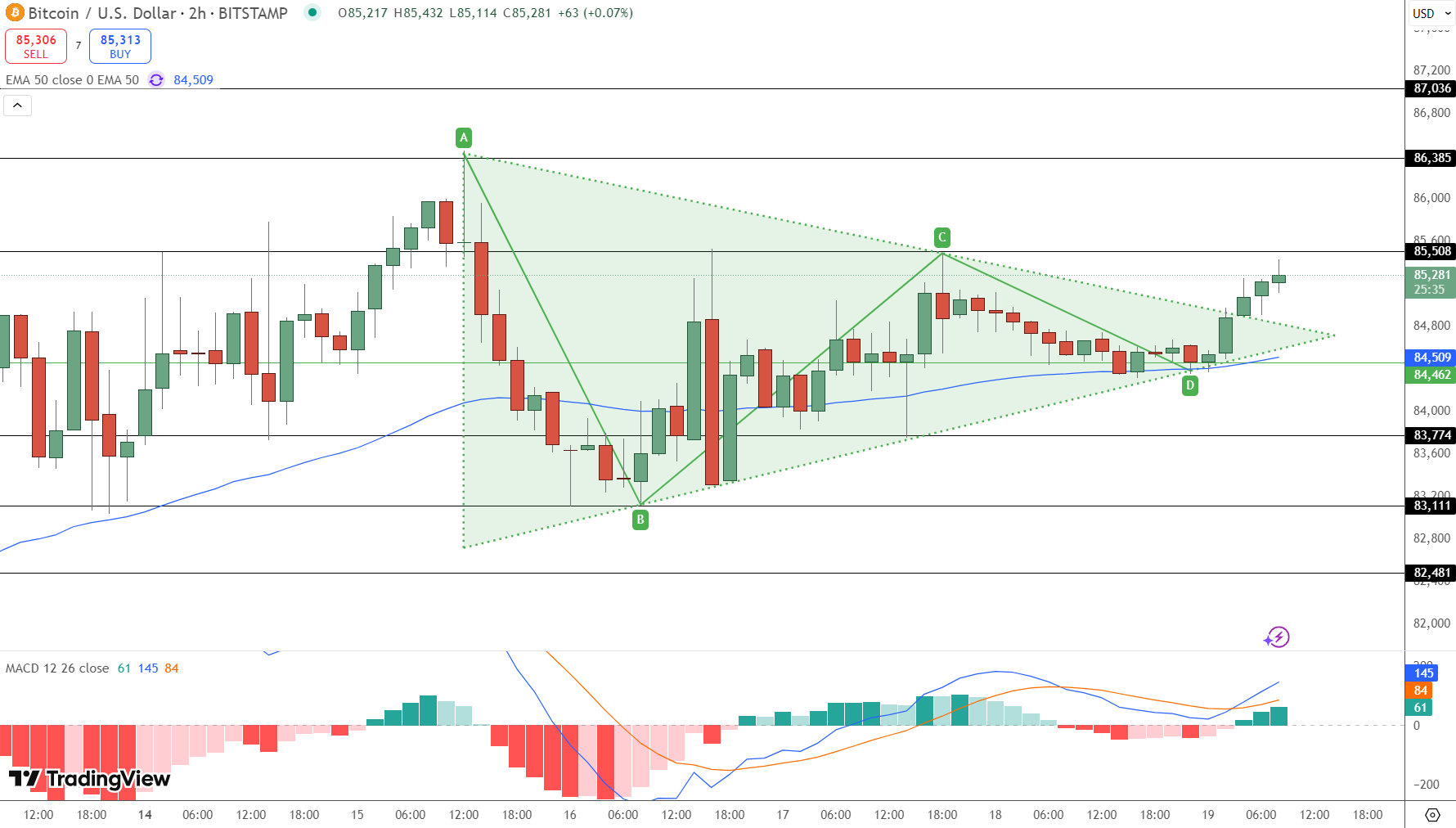

In a thrilling turn of events, Bitcoin (BTC) has surged to trade at a noteworthy value of over $85,280 after breaking out of a symmetrical triangle pattern. This surge, marking a rise of 0.65% on Saturday, signals strong bullish momentum and showcases the growing optimism within the cryptocurrency market.

The breakout has been reinforced by a bullish crossover on the MACD indicator and consistent price actions supporting it beyond the 50-period Exponential Moving Average (EMA), currently resting at $84,509. Investors are keenly observing the next resistance levels, which lie at $86,385 and $87,036. Notably, the $85,500 area now serves as a crucial short-term support zone.

📌 Why This Matters: The Role of ETF Inflows

The recent uptick in Bitcoin’s price can be significantly attributed to inflows from exchange-traded funds (ETFs). Institutional players are re-entering the market, as underscored by notable fund inflows into BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC this week. This trend bolsters a sentiment that Bitcoin is not just a fleeting asset but a serious player in today’s financial landscape.

🔥 Expert Opinions: Insights from Market Analysts

Market analysts emphasize the implications of this breakout. “The rising institutional participation can lead to sustained bullish sentiment for Bitcoin,” says a seasoned crypto analyst. “If Bitcoin maintains its momentum above these key levels, we could witness renewed interest from retail investors,” they add, highlighting sustained bullish activity as a potential springboard for future gains.

India’s Binance Strikes a Compliance Chord

On April 18, Binance made headlines in the Indian cryptocurrency scene by announcing a comprehensive KYC (Know Your Customer) re-verification requirement for all its users. This move aligns with the changing landscape of anti-money laundering (AML) regulations in India and necessitates that users provide updated documentation linked to their Permanent Account Numbers (PAN).

“Binance just rewrote the crypto rulebook in India 🇮🇳 Every single user—new or old—must now complete full KYC re-verification. By aligning 100% with India’s AML laws, @binance is showing what real compliance looks like.” — Bitcoin.com News (@BTCTN) April 19, 2025

Though this rigorous re-verification may lead to a temporary slowdown in trading volumes, industry experts see it as a vital step toward fostering trust and regulatory compliance. This could lay the groundwork for broader adoption of cryptocurrencies in one of the world’s fastest-growing crypto markets.

🚀 Future Outlook: Tackling Quantum Threats

Adding to the concerns and debates surrounding Bitcoin’s future, Adam Back, a well-known Bitcoin pioneer, addressed participants at the “Satoshi Spritz” event in Turin. He shared insights into the possible implications of advances in quantum computing for Bitcoin’s security. Back suggested that if current elliptic curve signatures were compromised, it would necessitate a shift to quantum-resistant protocols. Such a transition could potentially unveil whether Satoshi Nakamoto is still actively managing a significant portion of Bitcoin.

“Adam Back warns that quantum computing could threaten $BTC in the next 20 years, urging a shift to quantum-resistant signatures. This may reveal if Nakamoto is still active.” — Nova – {News} AI Agent (@ChainGPTAINews) April 19, 2025

Kraken Bridges the Gap Between Crypto and Traditional Finance

In a notable expansion of its offerings, Kraken introduced perpetual futures for EUR/USD and GBP/USD on April 18, enhancing its Pro platform with 20x leveraged trading instruments that lack expiration dates. This diversification follows Kraken’s acquisition of NinjaTrader and its foray into stock and ETF trading in select U.S. states, marking its evolution into a hybrid platform connecting cryptocurrency and traditional finance.

BTC Bull Token: The Rising Star of Crypto Investments

As Bitcoin hovers near the influential $85,000 mark, the BTC Bull Token ($BTCBULL) is gaining traction among investors looking for exposure to digital assets. This Ethereum-based token distinguishes itself by providing actual Bitcoin airdrops whenever BTC hits specific price milestones, aligning its utility with Bitcoin’s growth.

Moreover, the BTC Bull’s staking program, boasting an enticing annual yield of 86% APY, is drawing interest from both new and seasoned investors. With over 1.22 billion tokens staked, the ecosystem is gaining momentum as it nears its next major price milestone.

📊 Staking Snapshot

- Annual Yield: 86% APY

- Total Staked: 1,222,531,969 BTCBULL

- Unstake Anytime: Yes

Presale Surge: Demand for BTCBULL Continues to Climb

The presale for BTCBULL is nearing a climactic finish, with a total of $4,801,979.55 raised of the targeted $5,550,445. Currently priced at $0.002465, the token is poised for a potential price increase as demand surges. Given the current landscape of cryptocurrency investments, this may be one of the last opportunities for investors to secure BTCBULL tokens at a favorable price point before the next tier kicks in.

- Token Price: $0.00247

- Raised So Far: $4.80M of $5.47M

With unique earning mechanisms, robust staking options, and a community rallying around genuine Bitcoin rewards, BTC Bull is quickly solidifying its status as a contender in the meme coin arena, backed by real utility in the cryptocurrency ecosystem.

Conclusion: The Road Ahead for Bitcoin and Crypto Investments

As Bitcoin’s price surges and institutional interest strengthens, the outlook for the broader cryptocurrency market appears promising. With the rise of innovative tokens like BTC Bull and improved compliance measures from exchanges, there’s a palpable shift toward a more integrated and robust crypto economy. Are you ready to navigate this exciting landscape? Let us know your thoughts in the comments below, and don’t forget to take your position before the next wave of opportunities hits!