Bitcoin’s Tug-of-War: Market Dynamics at Play

On Wednesday, Bitcoin faced a slight downturn, dipping by 0.29% to $83,380 as market enthusiasts witnessed a fierce standoff between bullish and bearish forces. This tug-of-war reflects a broader sentiment that is shaping the cryptocurrency landscape—on one side, a surge of institutional interest; on the other, quiet sell-offs by significant governmental entities.

The Institutional Push: Meliuz’s Bold Move

In the spotlight this week is Brazilian fintech powerhouse Meliuz, which announced its intention to enhance its corporate treasury strategy by adding Bitcoin to its balance sheet. The company currently holds 45 BTC—valued at approximately $4.1 million—and aims to increase its Bitcoin stakes by utilizing operating income and fostering strategic partnerships. A pivotal shareholder vote scheduled for May 6 will decide if this digital asset will become part of Meliuz’s long-term reserve strategy.

This bold decision has already influenced market sentiments; shares of Meliuz (traded as CASH3) skyrocketed by 14% on the announcement and have surged an impressive 27% over the past five days, igniting a wave of optimism across the Latin American corporate crypto scene.

JUST IN: 🇧🇷 Brazilian listed company Méliuz buys 45.7 #Bitcoin for $4.1 million Bitcoin is good for corporations 🙌 pic.twitter.com/rCGiGYXdlR— Bitcoin Magazine (@BitcoinMagazine) March 6, 2025

What This Means for Bitcoin Adoption

Meliuz’s strategic investment marks a significant leap for institutional Bitcoin adoption within Latin America, echoing moves previously seen from the likes of MicroStrategy. With public corporations having acquired over 95,000 BTC in the first quarter of 2025, raising the global total to 688,000 BTC, this trend highlights Bitcoin’s growing acceptance as a legitimate corporate asset.

Expert Insights: Ripple’s Visionary Perspective

Adding to the excitement in the crypto sphere, Ripple’s CEO, Brad Garlinghouse, has made a startling prediction: Bitcoin could potentially soar to $200,000, provided regulatory reforms conducive to institutional investment continue to unfold. In a recent interview with Fox Business, Garlinghouse proposed that Ripple might settle its ongoing SEC case using XRP, with a reduced penalty of $50 million—substantially lower than the previous $125 million—with this payment potentially made in Ripple’s native asset.

Ripple might pay the SEC in XRP itself. Let that sink in 🇺🇸🔥Brad Garlinghouse says the $125M set aside is now just $50M… and XRP could be the currency of the deal. Total pivot from the SEC on how they see Ripple and crypto. But that’s not all. Garlinghouse just said he sees…— Bitcoin.com News (@BTCTN) April 16, 2025

A Broader Perspective: Global Market Reactions

As Bitcoin enjoys newfound institutional interest, contrasting developments are emerging from China, where municipal governments are discreetly selling approximately 15,000 BTC, valued at around $1.4 billion. These assets, previously seized during criminal investigations, are being liquidated to help mitigate domestic economic pressures.

JUST IN: 🇨🇳Local governments in China are using private firms to sell crypto for cash to fund public budgets. China reportedly holds 194,000 BTC (~$16B) 👀 pic.twitter.com/rPu74akb0t— Roxom TV (@RoxomTV) April 16, 2025

This trend, while presenting short-term challenges for Bitcoin prices, also signals a strategic pivot in how even heavily regulated jurisdictions are viewing Bitcoin as a viable asset for liquidity and funding public expenditures.

Current Market Dynamics: Bitcoin’s Technical Landscape

From a technical analysis standpoint, Bitcoin has recently breached its ascending channel and is now trading below the crucial 50-period exponential moving average (EMA) at $84,020. Currently hovering around $83,460, Bitcoin is testing key short-term support levels.

Recently observed indicators reveal:

- RSI: Currently at 38.5, indicating building bearish momentum.

- Key Support Levels: $82,488 and $81,354.

- Immediate Resistance Level: $84,020.

Strategizing Your Trades

For traders looking to navigate these conditions:

- Entry Point: Consider shorting below $83,300 after confirming the move.

- Target Price: Aim for $82,500 to $81,350.

- Stop Loss: Set at $84,300 to protect against unexpected upward movements.

As always, exercise caution—ensure that candles are closing with strong volume before entering positions to avoid falling victim to false breakdowns.

The Bigger Picture: Bitcoin’s Role in the Future

Bitcoin’s current price trajectory encapsulates a fascinating interplay between bullish institutional momentum and bearish pressures from high-profile sell-offs and regulatory concerns. With Ripple’s innovative settlement strategy and Meliuz’s treasury initiative adding depth to the narrative, the long-term outlook retains a strong undercurrent of optimism. Traders, however, would be wise to remain vigilant as price levels around $83K are pivotal.

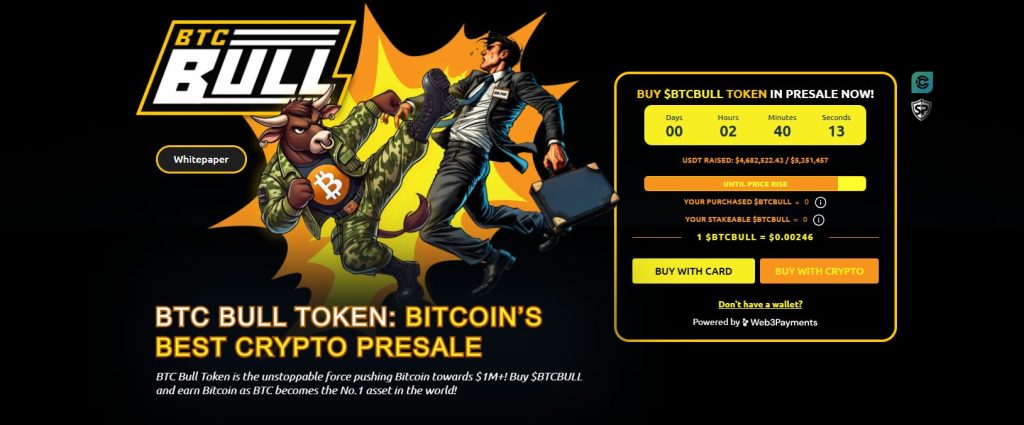

Spotlight on BTC Bull: Innovating the Presale Landscape

In other exciting news, BTC Bull ($BTCBULL) is making waves in the cryptocurrency presale arena. Designed to bridge meme culture and tangible utility, this token rewards its holders with real Bitcoin as key price thresholds are reached, aligning investor interests with Bitcoin’s growth trajectory.

As of now, BTC Bull’s presale updates show:

- Current Token Price: $0.00246 per BTCBULL.

- Funds Raised So Far: $4.6 million of a $5.3 million target.

With time running short and demand surging, now is a crucial opportunity to grab BTCBULL at presale rates before the anticipated price leap!

Let’s Discuss!

In a rapidly evolving cryptocurrency environment, how are you navigating these market changes? What do you think of institutional adoption in Latin America, and how do you see the price of Bitcoin playing out? Join the conversation and share your thoughts!