Crypto Market Surges: Trump Pauses Trade Tariffs, Sparking Recovery

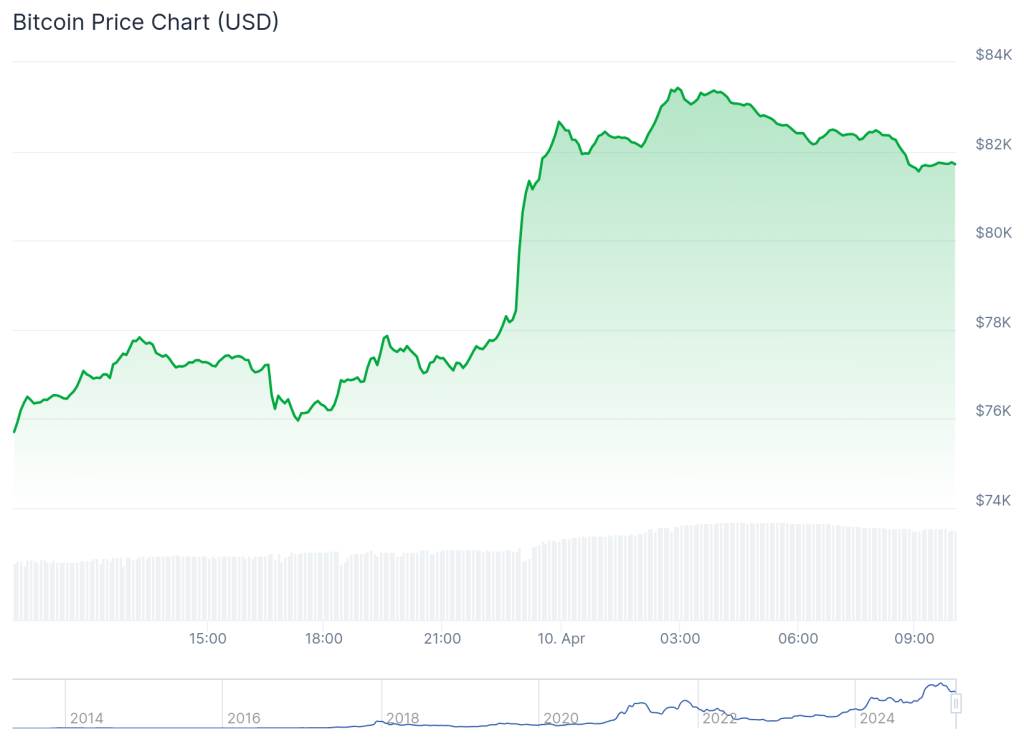

In an unexpected twist, the cryptocurrency market experienced a significant rebound on Thursday, igniting a wave of optimism among investors. This surge can be largely attributed to President Donald Trump’s announcement of a temporary halt to new trade tariffs, which has sent ripples through both digital assets and traditional equities. With Bitcoin initially soaring nearly 9% to around $82,500, followed by a slight dip to $81,700, and Ethereum climbing a staggering 13.4% to hit $1,611, it’s clear that this news has had a dramatic impact.

A broader look reveals that XRP also enjoyed a 13% uptick, while a multitude of altcoins posted impressive double-digit gains. This reversal is particularly noteworthy, coming on the heels of several challenging days in global markets, where rising trade tensions cast a long shadow over both stocks and cryptocurrencies. The shakeup began late Wednesday, when Trump rolled out a surprising 90-day pause on proposed tariff increases, catching many investors off guard and leading to a much-anticipated recovery.

📌 Why This Matters: The Significance of the Trade Pause

You might be wondering, why does this tariff pause matter for the world of cryptocurrency? The answer lies in the interconnectedness of global economic conditions. Trade wars often lead to financial uncertainty, which in turn affects market sentiment. When tariffs loom, investors generally pull back, fearing long-term consequences on growth and profitability. Trump’s pause provided a glimmer of hope, suggesting a potential easing of tensions, at least momentarily.

However, it’s crucial to note that while this move sparks temporary relief, underlying tensions remain. Trump’s rhetoric continues to underscore that duties on Chinese imports could still reach 125%, following a retaliatory increase from Beijing imposing 84% levies on U.S. goods. The uncertainty looming over these trade relationships can lead to unpredictable market shifts, urging investors to remain vigilant.

🔥 Expert Opinions: Analyzing the Market Response

Markus Thielen, head of research at 10X Research, offered a cautious perspective on the recent rally. He views the market bounce as potentially short-lived, citing persistent “structural headwinds” that could impact future performance, especially as the U.S. corporate earnings season approaches. While some traders celebrated the short-term gains, Thielen warns that volatility will likely remain a defining feature of the landscape.

This caution is echoed by data from Coinglass, which revealed a staggering 131,555 traders faced liquidations over the past 24 hours, amounting to an eye-watering $487.1 million. Bitcoin dominated these liquidations, accounting for $185.2 million, with Ethereum not far behind at $138.8 million. Such figures illustrate the high stakes involved in the crypto market and the inherent risks traders face.

🚀 Future Outlook: What Lies Ahead for Crypto Markets?

As we look ahead, the path of the cryptocurrency market remains uncertain. Despite the recent surge, analysts predict that volatility will persist, reinforced by ongoing trade tensions and market reactions to economic data releases. For investors, it raises an important question: how will they navigate these fluctuations amidst potential geopolitical upheavals?

Despite the encouraging news from Washington, traders would do well to stay informed about developments in trade negotiations and economic indicators. In a world where news can shift sentiment in a heartbeat, adaptability could become one of the investor’s greatest assets.

Conclusion: Navigating the New Normal in Crypto

The cryptocurrency market’s rebound offers a glimpse of hope, but this moment of recovery is just the latest chapter in an ever-evolving narrative. As traders and investors absorb this news, engaging with market shifts and staying alert to potential developments will be crucial. Are you ready to embrace the opportunities and challenges that lie ahead? Join the conversation and share your thoughts on this tumultuous yet exciting landscape of digital assets!