Tokenized Real-World Assets: A Rising Star in the Crypto Landscape

In the ever-evolving world of cryptocurrency, tokenized real-world assets (RWAs) are rapidly rising to prominence, emerging as a key player second only to stablecoins. A detailed investigation titled ‘RWA in On-chain Finance Report: H1 2025 Market Overview,’ conducted by innovative blockchain oracle RedStone in collaboration with Gauntlet and rwa.xyz, uncovers the explosive growth of this sector. The report illustrates how the tokenized RWA landscape has matured from a mere buzzword into a multi-billion-dollar financial ecosystem, captivating the attention of investors and institutions alike.

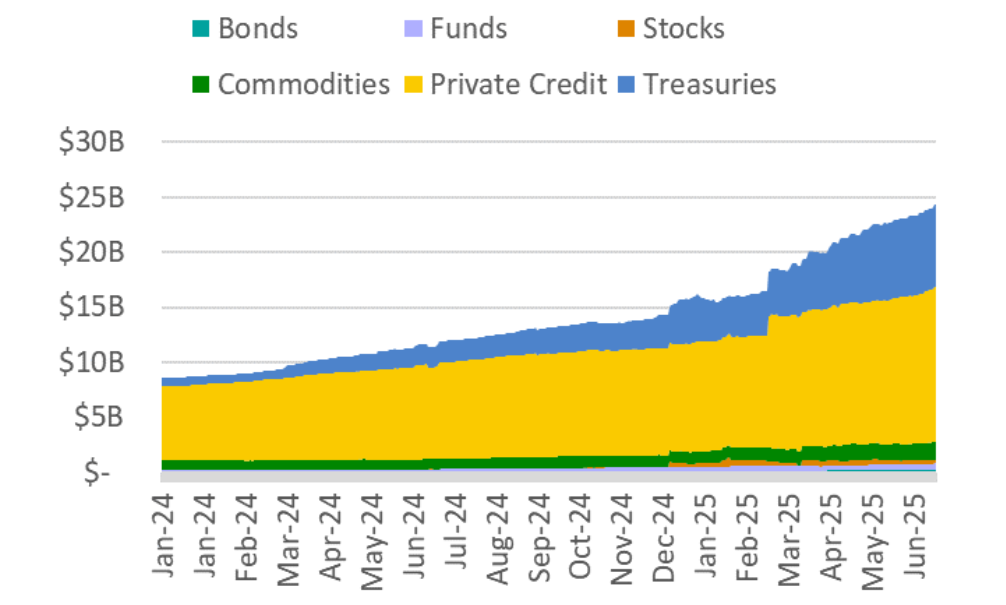

Unprecedented Growth in RWA Valuation

Recent data unveils astonishing progress within the tokenized RWA space. As of June 2025, the market’s total on-chain RWA value (excluding stablecoins) surged to a remarkable $24.31 billion, nearly tripling since January 2024. This represents an astonishing 380% increase, highlighting a sharp pivot from speculative theories toward real-world implementation.

2/ The RWA market value soared from $5B to $24B in just 2.5 years, marking a 380% increase.As RWAs exploded in size, demand shifted from theory to execution.This is no longer a “what if” scenario. It’s about what’s next.Scroll on for highlights.https://t.co/vr5VZongt6— RedStone ♦️ (@redstone_defi) June 26, 2025

To put this growth into perspective, the RWA value climbed from an estimated $5 million to a staggering $10 billion in 2022, with the first half of 2025 documenting a 260% increase from an initial valuation of $8.6 billion. Charting this trajectory, the current figures spot a market that is not just surviving but thriving, projecting even greater growth on the horizon.

Key Drivers of RWA Adoption

Several factors have propelled this rapid growth forward. The report cites higher interest rates as a major catalyst for the rising demand for tokenized yield-bearing assets. Moreover, the entrance of significant institutional players into the market has fueled this momentum, with platforms actively incorporating tokenized assets into their collateral and liquidity frameworks.

As outlined in the report, the transition from experimental pilots to full-scale institutional adoption of asset tokenization has been undeniable. The RWA market has exhibited remarkable resilience amidst global tensions, particularly in the wake of escalating military conflicts in the Middle East.

Understanding the Market Dynamics

The RWA tokenization landscape has not just demonstrated growth; it has also shown a remarkable adaptability to adverse conditions. Over a rapid 12-day period, the market expanded by $464 million, reaching its all-time high as of June 25, 2025. The sustained demand suggests that both institutional and retail investors recognize the potential of tokenized assets as a credible investment option, even when traditional markets face instability.

Private Credit: The Powerhouse of Tokenized RWAs

According to the report, private credit has emerged as the leading segment within the RWA tokenization sphere, comprising over half of the total market—around $14 billion. This shift marks a significant institutional appetite for blockchain-native credit markets, enhancing operational efficiency and unlocking innovative avenues for liquidity.

Looking Ahead: The Future of RWA Tokenization

The report highlights that the future of tokenization could lead to 10%-30% of global assets being tokenized by 2030-2034, bridging the enormous gap between traditional finance’s estimated $400 trillion in assets and the current $3 trillion crypto market. This vision signals the onset of a fundamental transformation in capital markets—not as an emerging asset class but as a vital enhancement to existing financial systems.

Conclusion: A Historic Shift Looms

Tokenized real-world assets are not just a trend; they are a sign of a broader evolution in how we view and manage assets. As major financial players like BlackRock and JPMorgan embrace tokenization, we are witnessing a monumental shift that could redefine the landscape of finance. The clear trajectory of investment and technological acceptance provides an optimistic outlook, inviting curious minds and investors to engage with this rapidly evolving ecosystem.

What’s your take on the rising importance of tokenized RWAs in the financial world? Join the conversation and share your thoughts below!