Vermont Exonerates Coinbase: A Key Victory for Staking Services

In a significant turn of events, the state of Vermont has officially dropped its legal action against Coinbase, one of the most prominent cryptocurrency exchanges in the world. This decision marks a pivotal moment for staking services amidst an evolving regulatory landscape in the United States. Coinbase’s Chief Legal Officer, Paul Grewal, announced the news via Twitter, celebrating Vermont’s decision as a step toward progress and much-needed clarity for digital asset holders.

Today the State of Vermont dismissed its action against @Coinbase regarding staking services. As we have always said: staking services are not securities. We applaud Vermont for embracing progress and providing clarity for its citizens who own digital assets. 1/3— paulgrewal.eth (@iampaulgrewal) March 13, 2025

Understanding the Dismissal: What it Means

The Vermont Department of Financial Regulation’s Securities Division initiated the dismissal without prejudice—meaning that while the case has been dropped for now, it can potentially be revived in the future under certain conditions. This nuance is essential as it indicates the evolving nature of cryptocurrency regulation and the ongoing dialogue around what constitutes a security.

Grewal emphasized the importance of this clarity, stating that Coinbase has consistently maintained that staking services do not fall under the category of securities. As states like Vermont navigate their regulatory frameworks, such statements can provide much-needed reassurance to investors and stakeholders.

Why This Matters: The Regulatory Landscape Shifts

This development isn’t merely a win for Coinbase; it signals a broader transformation in how U.S. regulators are addressing the burgeoning cryptocurrency market. Just days before Vermont’s dismissal, the U.S. Securities and Exchange Commission (SEC) announced a task force aimed at crafting comprehensive rules for the regulation of crypto products and services.

As the SEC pivots towards more defined guidelines, industry leaders are hopeful. The clarity provided to stakeholders can potentially foster innovation while also ensuring consumer protection—setting the stage for the crypto industry’s next chapter.

Expert Insights: Navigating Future Regulatory Changes

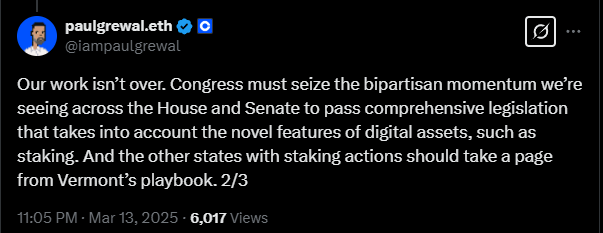

Industry analysts are weighing in on the implications of these recent changes. Grewal issued a clarion call for Congress to act swiftly, leveraging what he described as a “bipartisan momentum” to create comprehensive legislative frameworks for digital assets. His stance underscores a critical need: the cryptocurrency sector demands systematic rules—flawed yet defined—to build on its foundations.

Grewal highlighted strong support from key political figures, such as Senator Tim Scott, who expressed confidence in the feasibility of swift legislative action. This collaborative approach could lead to tangible protections for consumers and investors, fostering a more supportive environment for crypto innovation.

1. We need predictable, even if imperfect rules, that last. Building this technology is hard enough as it is. And consumers/investors deserve basic protections.2. I’d say pretty good chances. @SenatorTimScott has suggested he and others (including @gillibrandny)…— paulgrewal.eth (@iampaulgrewal) March 14, 2025

Future Outlook: What Lies Ahead?

With the recent dismissal and the SEC’s shift in priorities, many are wondering what lies ahead for Coinbase and the broader cryptocurrency market. In July 2023, Coinbase paused its staking services in several states, including Vermont, in response to legal actions stemming from SEC allegations of offering unregistered securities. This decision significantly impacted its operations.

However, with the recent changes, litigation against Coinbase is not the only matter shifting. The SEC has also chosen to drop other high-profile lawsuits against major players like Kraken and Gemini—a clear indication of a new era in regulatory strategy. Recent developments suggest a bullish sentiment in the market.

In an exciting twist, Coinbase has announced plans to launch 24/7 trading for Bitcoin and Ethereum futures through its CFTC-regulated derivatives platform, providing U.S. traders unprecedented opportunities. This feature, allowing for perpetual-style futures contracts, is set to revolutionize trading dynamics.

Conclusion: Join the Discussion

As Vermont’s actions ripple through the crypto ecosystem, the implications are profound—not just for Coinbase but for all digital asset stakeholders. The dialogue around regulatory frameworks is open, and its outcomes will shape the future of cryptocurrency. How do you see these changes affecting the landscape? Share your thoughts and engage in the conversation surrounding this evolving narrative. The future of crypto is brighter, and your voice matters.