Tim Draper’s Bold Bitcoin Prediction: A $250,000 Forecast for 2025

Renowned venture capitalist Tim Draper is once again stirring excitement in the cryptocurrency community with his audacious prediction that Bitcoin will soar to $250,000 by the end of 2025. Known for his innovative insights into the digital currency market, Draper has a solid track record; he accurately foretold Bitcoin reaching $10,000 back in 2014—an achievement it accomplished by November 2017. His latest forecast, however, raises the stakes significantly. As of March 2025, Bitcoin is valued around $80,000, with an all-time high of $109,000 reached in January. So, is it plausible for Bitcoin to triple in value within the next nine months?

Why This Matters: The Implications of Draper’s Prediction

Draper’s projections are significant not just for Bitcoin enthusiasts but for the entire financial landscape. With his willingness to look beyond traditional price indicators means evaluating Bitcoin’s worth in terms of consumer goods rather than fiat currency. As inflation continues to erode the purchasing power of the dollar, Draper advocates for assessing Bitcoin’s value against tangible items—a dozen eggs, for instance—indicating a paradigm shift in how we view money in an inflationary world.

Decoding Draper’s Logic: Factors Driving His Forecast

Tim Draper’s $250,000 price tag isn’t just a whimsical number; it’s rooted in several critical factors that could spur Bitcoin’s growth:

- 1. The Halving Effect: A Supply Shock Awaits

The scheduled Bitcoin halving event taking place in April 2024 will slash the mining reward from 6.25 BTC to 3.125 BTC, effectively halving the new supply entering the market. Historically, past halvings have led to explosive price increases:- The 2012 halving ignited an 8,000% rise within a year.

- Bitcoin saw a staggering 2,800% surge after the 2016 halving, culminating in the monumental peak of 2017.

- In 2020, Bitcoin climbed 700% within 18 months of the halving event.

- 2. Institutional Interest Grows: The Role of Spot Bitcoin ETFs

The approval of Spot Bitcoin ETFs in January 2024 has opened the floodgates to institutional investment. As of March 2025, significant firms like BlackRock and Grayscale collectively manage over $37 billion in Bitcoin investments. This surge in institutional involvement not only enhances market legitimacy but also tightens the supply chain. - 3. Global Adoption: Bitcoin’s Status as Legal Tender

Countries such as El Salvador and the Central African Republic have embraced Bitcoin as legal tender, paving the way for mainstream acceptance. Noteworthy developments, including Argentina’s embrace of pro-Bitcoin policies under President Javier Milei, further accelerate adoption—while central banks in regions like Hong Kong and the UAE are contemplating Bitcoin as part of their reserves.

Analyzing Bitcoin’s Price Dynamics: Technical Insights

Currently, Bitcoin appears to be in a consolidation phase, characterized by a symmetrical triangle pattern on its two-hour chart, hinting at an imminent breakout. The future direction of this movement remains uncertain.

Key Resistance Levels: The $84,000 mark is identified as a critical resistance zone, aligning with a descending trendline. A successful breakthrough here could potentially propel Bitcoin towards new price points—$87,000, and even $91,000.

Support Levels: On the flip side, should Bitcoin struggle to surpass $84,000, the immediate support level rests at $79,000. Further declines could push it down to $75,000 or even $72,000.

Technical Indicators: The 50-period Exponential Moving Average (EMA) indicates dynamic resistance at $82,500. A decisive breakout above $84,000 may trigger bullish momentum, while a drop below $79,000 could signal a shift towards bearish sentiment.

Future Outlook: Can Bitcoin Reach $250K?

While Draper’s ambitious price prediction raises eyebrows, the historical trends surrounding Bitcoin post-halving certainly provide grounds for excitement. However, potential roadblocks linger:

- Regulatory Uncertainty: Ongoing discussions about crypto regulations could impact market stability.

- Macroeconomic Factors: The Federal Reserve’s monetary policies, especially around interest rates, play a significant role in risk asset performance.

- Market Sentiment: Active participation from both retail and institutional investors will heavily influence Bitcoin’s trajectory moving forward.

That said, with the right combination of institutional demand and adherence to historical trends, a six-figure Bitcoin price could be on the table by late 2025.

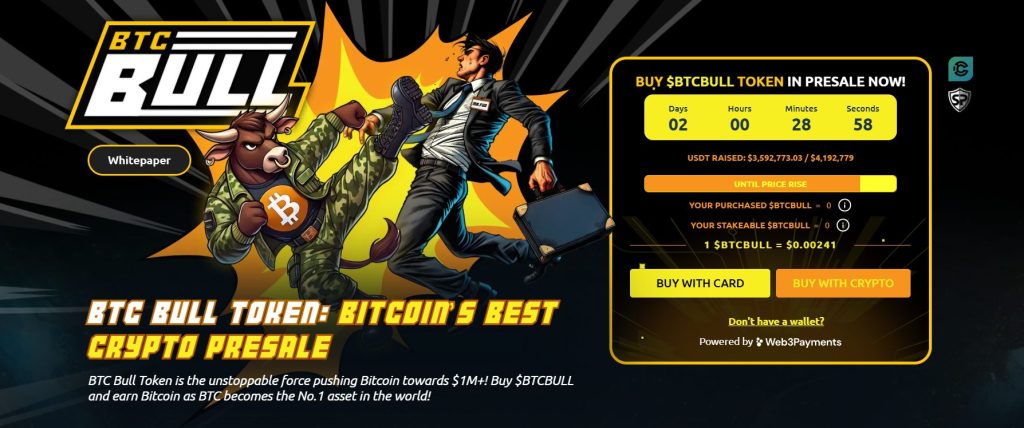

Spotlight on BTC Bull: Earn Rewards While Investing

In an intriguing development within the crypto space, BTC Bull ($BTCBULL) has emerged as a community-focused token that rewards holders with real Bitcoin as the price reaches specific milestones. Unlike conventional meme tokens, BTC BULL is engineered for those looking for long-term investment opportunities, offering a robust incentive structure through airdropped Bitcoin rewards and lucrative staking possibilities.

BTC Bull Features:

- Staking & Passive Income: Participants can enroll in a high-yield staking program featuring a whopping 119% APY, allowing tokens to generate passive earnings.

- Presale Insights: The ongoing presale is currently priced at $0.00241 per BTCBULL, with $3.5 million raised out of a targeted $4.1 million.

With surging demand, now seems to be a pivotal moment for acquiring BTCBULL tokens at introductory rates before the price escalates.

Conclusion: Join the Conversation!

The cryptocurrency landscape is continuously evolving, and predictions like Draper’s only add to the anticipation. Are you ready to share your thoughts? Do you believe Bitcoin will hit the $250,000 mark? Join the discussions below and let us know your take on the future of Bitcoin!