Ethereum’s Struggles: A Painful Downtrend Continues

Ethereum (ETH) investors are grappling with disappointment as the cryptocurrency market’s current landscape presents an unsettling image. As ETH continues to falter against formidable competitors like Bitcoin, investors are left wondering about the future of their assets. Despite a recent deceleration in US consumer price inflation, which could potentially allow the Federal Reserve to ease interest rates in 2025, Ethereum’s price remains stubbornly ensnared below the critical $2,000 mark.

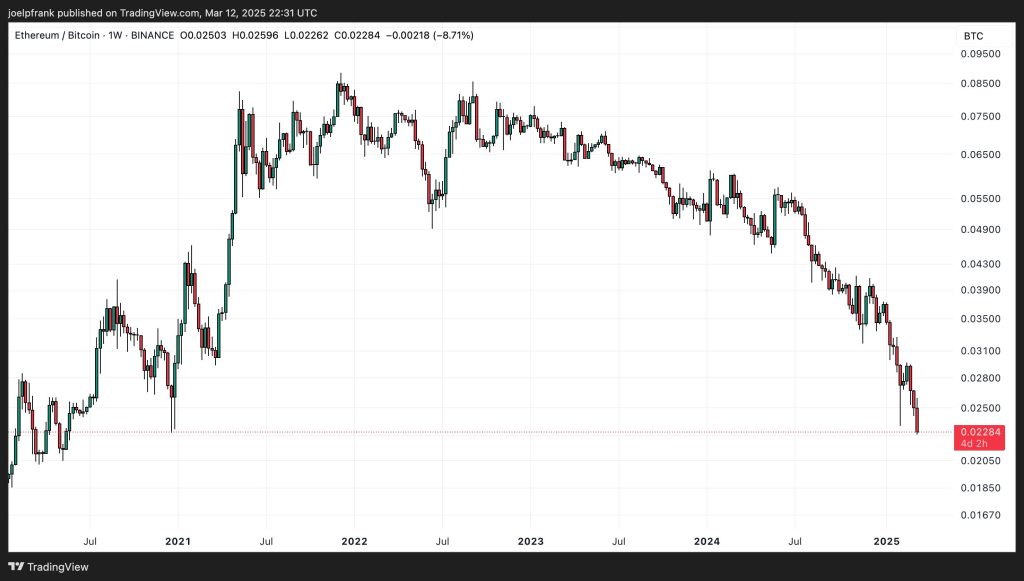

The Ether-Bitcoin Struggle: A Low Point?

Contrasting sharply with the brief recovery seen in major cryptocurrencies like Bitcoin, XRP, and BNB, Ethereum finds itself in a precarious situation. The ETH/BTC ratio recently dipped to a nearly five-year low, dropping below 0.023. Such a steep decline raises alarms among ETH investors—could we soon witness a retest of the 2019 lows around 0.016? This imminent threat amplifies concerns regarding Ethereum’s standing in the competitive crypto landscape.

Bearish Signals: A Shift in Market Sentiment

The technical indicators are far from optimistic. Ethereum’s price chart recently breached the vital long-term resistance level of $2,140, now leading experts to suggest that the bullish price range of $2,000 to $4,000 seen in early 2024 may be fading into the rearview mirror. Observers are now keenly focused on the next significant support level, projected around $1,500. Bears have their eyes locked on this critical threshold as bearish momentum seems increasingly likely.

Why This Matters: Economic Background and Implications

While a cooling inflation rate in the US hints at possible Fed relief, the broader macroeconomic picture remains troubling. Factors like austerity measures and the fallout from the Trump administration’s trade policies raise concerns about economic growth and recession risks. In fact, experts like Mohamed El-Erian have recently indicated that the likelihood of a recession could be as high as 30%—a stark jump from earlier estimates of 10% this year.

Mohamed El-Erian, a Bloomberg Opinion columnist, says the chance of a US recession is now at 25%-30%. El-Erian had the probability of a recession at 10% at the beginning of the year. https://t.co/uM8FjGPhCZ

Expert Opinions: Insights from the Crypto Community

Given the current climate, some analysts advocate for caution when considering Ethereum as a viable investment option. Cryptocurrencies are known for their volatility, and with significant bearish sentiment in the air, many believe that holding off on new investments until Ethereum reaches lower levels might be a smart move. However, others see the current dip as an opportunity.

Traders who take on a long-term view may find value in accumulating ETH at these lower levels, particularly if they believe in a market rebound fueled by future liquidity injections from the Federal Reserve. Historically, strong recoveries for Ethereum have coincided with liquidity surges. Additionally, the ongoing support from the Trump administration toward cryptocurrency could signal a potential turnaround for ETH in the longer term.

Future Outlook: Can Ethereum Bounce Back?

Despite the present challenges, the future may still hold promise for Ethereum. Its status as the leading platform for decentralized finance (DeFi) and smart contracts continues to attract interest from major institutional investors. As market conditions eventually stabilize, there is a real possibility that Ethereum could reclaim its footing.

However, some hurdles still lie ahead. Ethereum’s market share is under pressure as more nimble competitors emerge, capturing new users at a faster pace. Yet with its historical reputation as the most trusted smart contract blockchain, Ethereum is well-positioned to recover once investor sentiment shifts positively.

Conclusion: Is Now the Time to Buy the Dip?

As Ethereum appears destined for a potential dive to $1,500, investors are left pondering: is this the moment to pounce? For those willing to navigate the inevitable turbulence, there may be substantial upside potential in buying ETH during this downturn. The narrative surrounding Ethereum remains strong, driven by both institutional backing and the promise of a pro-crypto future under the Trump administration. Hustling through uncertainties, Ethereum could very well be on the path to reaching highs like $10,000 by the end of the upcoming four years.

What do you think? Are you considering buying the dip, or are you waiting to see how market conditions evolve? Join the conversation below!