Bitcoin’s Bumpy Ride: Institutional Interest and Market Challenges

As the cryptocurrency landscape evolves, Bitcoin remains a focal point, currently hovering below the pivotal $85,000 mark. The excitement around institutional adoption is unmistakable, particularly with notable players making bold moves. For instance, Rumble, a rapidly growing video-sharing platform, has made headlines by acquiring 188 Bitcoin worth approximately $17.1 million. This strategic investment underscores Bitcoin’s appeal as a potential hedge against inflation in light of shifting U.S. economic policies.

State-Level Initiatives: Texas Steps Up for Bitcoin

In a significant development, Texas is laying the groundwork for broader state-level adoption of Bitcoin through a proposed $250 million investment plan. Introduced by Representative Ron Reynolds, House Bill 4258 aims to empower the state comptroller to allocate substantial resources to Bitcoin and other cryptocurrencies. Local governments could also get in on the action, with the potential to invest up to $10 million each.

This legislative initiative could mark a turning point, setting a precedent for other states considering similar paths toward crypto investment. If passed, the new law would take effect on September 1, 2025, and could spur increased institutional confidence in Bitcoin, further legitimizing its role in state financial strategies. Other related bills, such as Senate Bill 778 and Senate Bill 21, focus on establishing a Texas Strategic Bitcoin Reserve, emphasizing the state’s commitment to cryptocurrency.

Texas introduces new #Bitcoin reserve bill, seeks $250 million investment pic.twitter.com/ESE6I0R33m— Crypto Briefing (@Crypto_Briefing) March 11, 2025

Bitcoin’s Market Position: Resistance and Opportunities

As Bitcoin flexes its muscles, it seems to hit a wall around the $85,000 barrier. Following the recent Consumer Price Index (CPI) report revealing softer-than-expected inflation, Bitcoin surged to approximately $83,500. Yet, the continuing outflows from Bitcoin exchange-traded funds (ETFs)—totaling around $1.5 billion this March—cast a shadow over price momentum, compelling investors to proceed with caution.

While Bitcoin is relatively flat, the rest of the cryptocurrency market is buzzing. We witnessed altcoins like Pi Network (PI) jumping a remarkable 22%, alongside other notable gains from Hedera (HBAR) and Binance Coin (BNB). This reflects an increasing risk appetite among investors, looking for opportunities beyond Bitcoin.

I’ve said it before, and today’s CPI data proves it again: Bitcoin’s resilience is unmatched.— Cade O’Neill (@CadeONeill) March 12, 2025

The Road Ahead: Technical Analysis of Bitcoin’s Price Action

Bitcoin’s recent technical analysis indicates a critical juncture as it tests the resistance level near $83,800. Currently trading at $83,431, Bitcoin is positioned close to the 50-period exponential moving average (EMA) at $82,973. This is a key indicator for short-term traders looking for bullish or bearish signals.

A successful breach of $83,800 could spark a rally towards $86,973 and possibly even $91,054. Conversely, if Bitcoin fails to break through this resistance, it may test support at $78,529, with a more significant drop towards $75,195 as the next critical level to watch.

Investor Insights: What Lies Ahead for Bitcoin? 📊

The ongoing dynamics in Bitcoin’s ecosystem hinge significantly upon ETF inflows and the growing interest from institutional investors. A decisive daily close above $84,000 may confirm bullish sentiment, setting the stage for potentially larger price maneuvers.

BTC Bull: A New Player in the Crypto Space 🚀

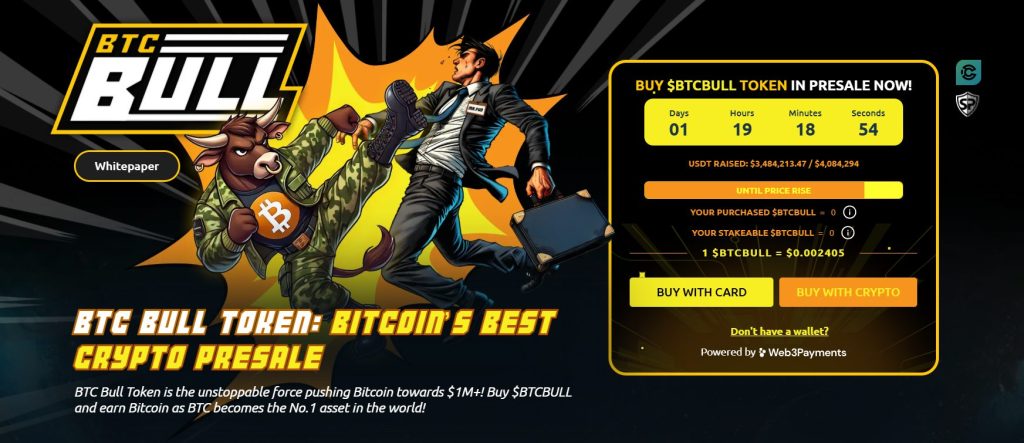

Among the waves of innovation in the cryptocurrency scene, BTC Bull ($BTCBULL) is emerging as a community-powered token that offers users the compelling advantage of earning real Bitcoin rewards. Uniquely designed to automatically airdrop Bitcoin as it reaches specific price milestones, BTCBULL is capturing the attention of long-term investors seeking consistent rewards.

With high-yield staking options offering a jaw-dropping 154% annual percentage yield (APY) and significant community participation, the BTC Bull presale is generating buzz, having already raised $3.4 million, aiming for a target of $3.66 million. At a current presale price of just $0.002405 per BTCBULL, this might be the opportune moment for investors looking to capitalize on the future of cryptocurrencies.

Conclusion: Join the Discussion 💬

The world of Bitcoin and cryptocurrencies is constantly evolving, and the latest developments signal significant shifts in institutional interest and market dynamics. With numerous factors at play, from new legislative proposals to market resistance levels, the path forward remains uncertain yet filled with potential for savvy investors. What are your thoughts on Bitcoin’s current performance, and how do you think these institutional moves will influence the wider crypto market? Join the conversation below!