Cryptocurrency Market Faces Turbulent Times Amid Trade Tensions

The cryptocurrency market experienced a significant downturn on Tuesday, with a staggering 6% drop in overall value, largely influenced by rising uncertainties surrounding President Trump’s latest trade policies. This plunge hasn’t just affected digital currencies; it echoes through the entire financial landscape, causing widespread anxiety among investors eager to understand the implications of ongoing trade tensions with major partners like Canada, Mexico, and China.

📌 Why This Matters: The Ripple Effects of Trade Policies

The adverse reactions in the crypto market serve as a microcosm of investor sentiment in times of economic uncertainty. With the S&P 500 erasing all gains since Trump’s re-election on November 5 and declining nearly 3%, it’s clear that heightened fears over trade and economic slowdown are permeating through various asset classes.

Cryptocurrencies, often viewed as volatile risk assets, have particularly felt the brunt of these tensions. Bitcoin has plummeted to $79,415—a decline of 3.4%—while Ethereum faced an even sharper drop of 9.4%, plummeting to $1,963. Other major cryptocurrencies such as XRP and Dogecoin followed suit, reflecting widespread fear that investors are cycling back to cash or safer assets amidst economic uncertainty.

🔥 Expert Opinions: Insight from Market Analysts

Agne Linge, the head of growth at decentralized on-chain bank WeFi, highlights the caution that permeates the market: “The crypto market continues to exhibit risk-on behavior, with investor sentiment remaining cautious despite key developments.” Her comments highlight the psychological impact of the trade conflict and the disappointment over the administration’s announcement regarding a Strategic Bitcoin Reserve, which many see as inadequate in alleviating market fears.

Even as policies evolve, concerns about prolonged trade disputes and inflation loom large. “Ongoing trade disputes could further exacerbate inflation concerns,” Linge emphasized, hinting at potential macroeconomic instability that could keep the market fraught with volatility in the coming weeks.

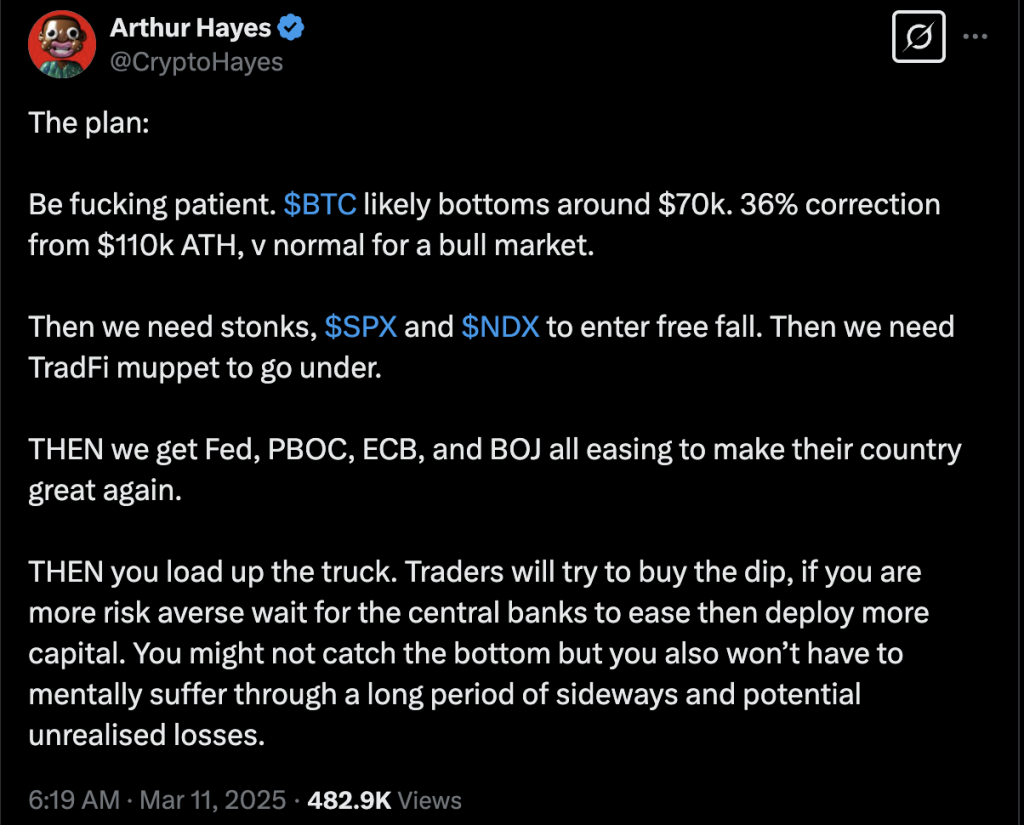

🚀 Future Outlook: Navigating a Rocky Road Ahead

The heavy sell-offs have materialized into alarming liquidation events. In the past 24 hours, over $939 million in crypto positions were liquidated, impacting around 331,426 traders, according to data from CoinGlass. Bitcoin alone accounted for approximately $315 million of this loss, indicating the substantial risk that traders are exposed to amid these turbulent market conditions.

Market analyst Ruslan Lienkha notes the broader economic realities at play. “Pessimism has prevailed in the US stock market, and the looming threat of a recession is stirring unease,” he pointed out. “Given these factors, the current consolidation phase could evolve into a medium-term bearish atmosphere.” He elaborated on the interconnectedness of crypto and traditional finance: “The crypto market is unlikely to thrive if the equity market undergoes a significant correction.”

The Edge of Volatility: Are We Heading for More Liquidations?

As volatility grips both traditional equities and digital assets, traders are likely contemplating alternative strategies. Many are drawn toward options trading as a means to hedge losses in spot markets, a trend reflecting heightened anxiety across the financial spectrum. The question now remains: will the ongoing trade disputes and economic uncertainty result in prolonged bearish trends, or could it pave the way for a recovery? Only time will clarify the intricate dance between crypto assets and global economic policies.

🔮 Conclusion: What Lies Ahead for Crypto?

The cryptocurrency market stands at a critical juncture, caught in the crosshairs of economic policy and investor sentiment. With the landscape constantly shifting, it’s crucial to remain informed and adaptable. What are your thoughts on the potential impact of trade tensions on the cryptocurrency market? Join the discussion and share your insights!