Solana’s Price Drop: A Deeper Analysis

In an unsettling turn of events, Solana (SOL) has seen its market value shrink to $124, reflecting a 3% decline in just 24 hours. This recent dip is part of a larger trend, as the entire cryptocurrency market has retraced by 4% during the same time frame. To put this into perspective, Solana has experienced a significant downturn over the past week, losing 9%, and in the realm of monthly performance, the altcoin has fallen by a staggering 38%. Even looking at year-to-date figures reveals a grim picture, with SOL down a hefty 16%.

The Crippling Factors Behind Solana’s Struggles

The challenges for Solana have been compounding in recent weeks. A notable decrease in interest surrounding meme tokens, attributed to various market influences, has stifled demand for SOL. Adding to this pressure is the substantial unlocking of tokens related to the FTX estate, which has put further strain on the asset’s stability. Could investors be witnessing a point of no return for Solana? The cryptocurrency’s trajectory, paired with challenging macroeconomic headwinds, suggests that it might take a while before we see a genuine recovery rally for SOL.

Is a Crash Below $100 Inevitable?

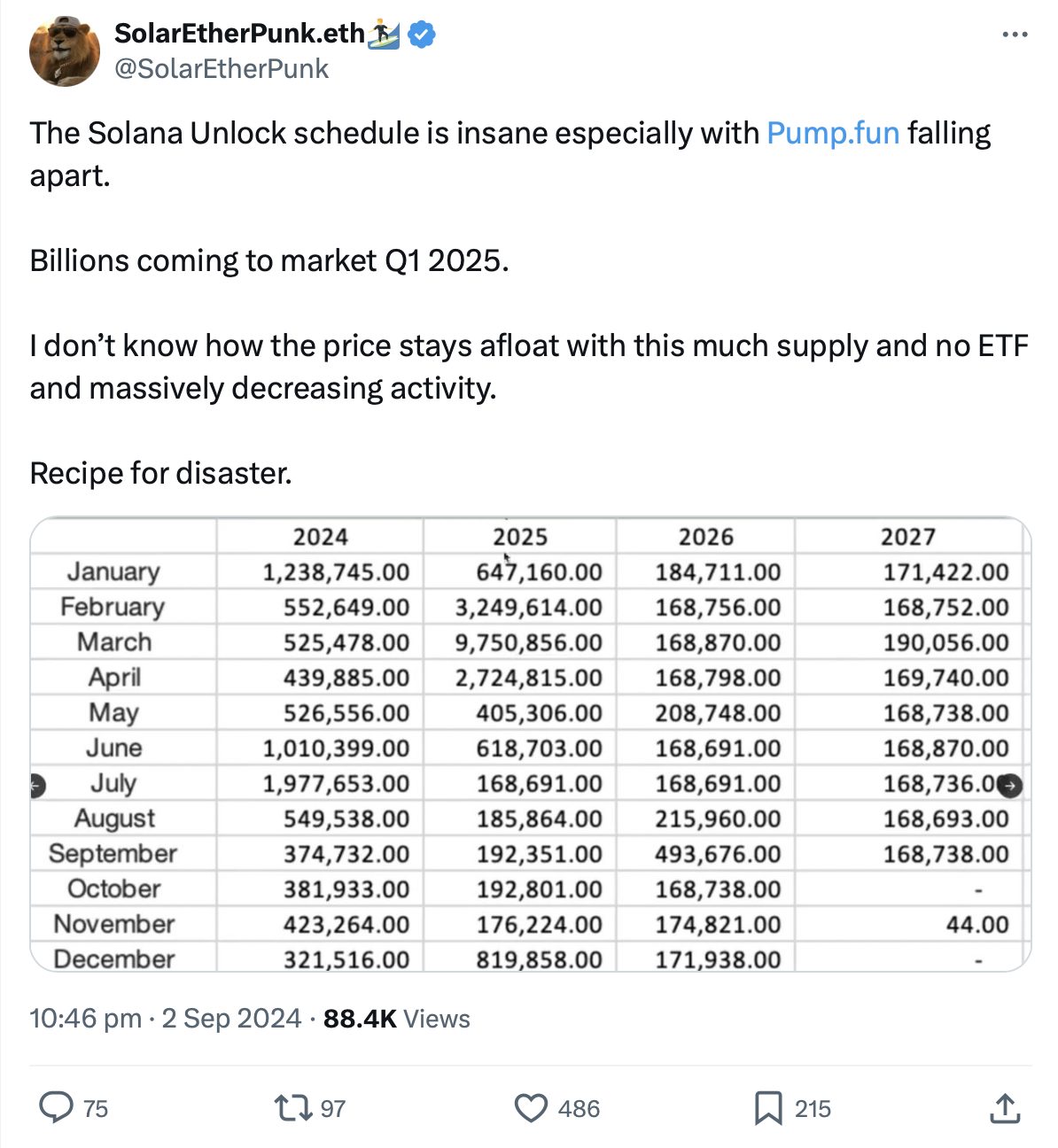

Cautious observers have been speculating about Solana’s future since last year, particularly with a busy unlock schedule looming for 2025. At that time, around 18 million SOL—valued at an estimated $2.23 billion—will flood the market. This prospect raises important questions: Will recipients, primarily large asset managers like Galaxy Digital and Pantera Capital, contribute to a sell-off, or will they hold their positions? The uncertain market conditions exacerbate fears over Solana’s price stability.

Sitting at a disquieting 57% decline since January 19, Solana’s current performance starkly contrasts Bitcoin, which has dropped just 25% during the same timeframe. Observers are pointing towards a decrease in enthusiasm for meme coins, particularly those related to Solana’s ecosystem. February saw a monumental plunge in volumes—over 60% for platforms like Pump.fun—with various external factors shaking investor confidence.

Reinventing Solana: The Road Ahead

As Solana grapples with rising concerns, it faces the pressing challenge of redefining its identity beyond a meme coin haven. Upcoming technological advancements, such as the rollout of the highly anticipated Firedancer validator client, aim to enhance both efficiency and stability within the network. If the broader market begins to recover in tandem with these upgrades, could we realistically see Solana’s price soar back to $200 by the second half of the year? Analysts suggest that we might be nearing a bottom; a calming of ongoing geopolitical tensions could provide a much-needed boost.

Spotlight on New Opportunities: The Rise of Solaxy

While veteran players like Solana face turbulent waters, savvy traders are exploring alternative investments, particularly within the realm of presale tokens. Among them is Solaxy (SOLX), which has impressively raised over $25.8 million as it gears up to launch Solana’s inaugural layer-two network. This initiative aims to tackle ongoing issues around failed transactions, outages, and network congestion that have plagued the primary blockchain.

Set to launch in the coming weeks, Solaxy promises a seamless experience for both users and traders, with its SOLX token designed to handle transaction fees. As adoption grows, demand for SOLX is expected to skyrocket, enabling quick bridging between Solana and other blockchain networks after its debut. Currently priced at $0.001572, investors can participate in its presale via the official site—an opportunity to engage with a potential market standout.

Conclusion: The Need for Strategic Reflection

Solana’s recent downturn serves as a sobering reminder of the volatility inherent in the cryptocurrency space. The combined pressures of token unlocks, shifts in market sentiment, and technological transitions challenge SOL’s standing among its peers. As investors process these developments, now is a critical moment to reflect on market strategies and explore emerging opportunities like Solaxy. What do you think lies ahead for Solana? Will it emerge from this downturn stronger than ever, or is it set for a prolonged struggle? The discussion is open, and the future remains tantalizingly uncertain.