Bitcoin Takes a Hit Amidst Turbulent Market Conditions

In a dramatic turn of events, Bitcoin’s price has taken a nosedive, falling 4.13% to $82,331.29 as a reaction to President Donald Trump’s recent Executive Order regarding a Strategic Bitcoin Reserve. This mandate initially triggered a swift 5% drop for the digital currency, highlighting the volatile nature of cryptocurrency trading. With trading volumes soaring to an impressive $39.1 billion, market participants are left grappling with uncertainty regarding the U.S. government’s intentions towards Bitcoin acquisition.

🌍 Trade War Tensions & Bitcoin Update 📊 Canada, China & Mexico strike back with tariffs, fueling market uncertainty! Meanwhile, #Bitcoin faces major swings—$70K support & $75K resistance are key levels to watch — Bitunix Analyst🔍 Stay sharp, trade smart & manage your risk! pic.twitter.com/F80ltdXdQx — Bitunix (@BitunixOfficial) March 5, 2025

This unexpected shift in governmental policy has injected a fresh wave of volatility into the market, leaving investors questioning whether this recent dip represents a compelling buying opportunity or a precursor to further declines. With Bitcoin seemingly trapped below the $82,000 mark and experiencing persistent selling pressure, the market atmosphere remains charged with apprehension.

Trade Tensions Weigh Heavily on Bitcoin’s Performance

The implications of Trump’s Executive Order extend beyond the realm of cryptocurrency. Ongoing trade tensions among the U.S., Canada, and Mexico have created an air of uncertainty that pervades financial markets. Changes in U.S. tariffs and agreements under the US-Mexico-Canada Agreement (USMCA) have caused volatility not only in stocks but also in the risk-sensitive domain of cryptocurrency.

Such trade policy fluctuations have compelled investors to adopt a more cautious approach, particularly concerning risk assets like Bitcoin. Despite Bitcoin’s reputation as a hedge against traditional financial instability, the immediate sentiment continues to lean bearish, suggesting that uncertainty largely dictates market behavior at present.

Upcoming Economic Data: A Crucial Crossroad for Bitcoin

Looking ahead, the next significant test for Bitcoin hinges on forthcoming economic indicators, particularly inflation data. The release of the Consumer Price Index (CPI) on March 12 and the Producer Price Index (PPI) shortly thereafter will be pivotal in shaping market expectations and, consequently, Bitcoin’s price trajectory.

The digital currency market is on the verge of an important change. Publishing Consumer Price Index (CPI) and US Producer Price Index (PPI) in the coming days can determine the path of Bitcoin and other digital currencies in the next few months. pic.twitter.com/wK1Euq0dXx — Reza Trader (@RezaTraderFarsi) March 9, 2025

Market analysts predict a CPI increase of 0.3% for February, resulting in an annual inflation rate of 2.9%. Additionally, the PPI data will substantially influence market outlook, especially as traders speculate about potential interest rate cuts by the Federal Reserve. With forecasts suggesting up to 70 basis points in rate reductions by December, the results from the March 18-19 Federal Reserve meeting may either bolster or diminish Bitcoin’s momentum.

Technical Analysis: Will Bitcoin Hold the Line?

From a technical perspective, Bitcoin faces an uphill battle as it strives to reclaim a critical resistance level of $82,725. Currently, it appears mired in bearish sentiment, as indicated by the 50-period EMA. A sustained failure to break above $83,990 may trigger further declines, leading to heightened selling pressure.

Analysts highlight these pivotal levels to watch:

- Resistance Levels: $82,725 and $83,990

- Support Levels: $80,070, with potential drop zones at $78,196 and $76,198

A breach below the $80,070 support might usher in an avalanche of selling activity, amplifying the current bearish trend. Traders are urged to be vigilant, monitoring volume and shifts in market sentiment as signals for positioning.

Riding the Next Wave: Innovations in Crypto Investment

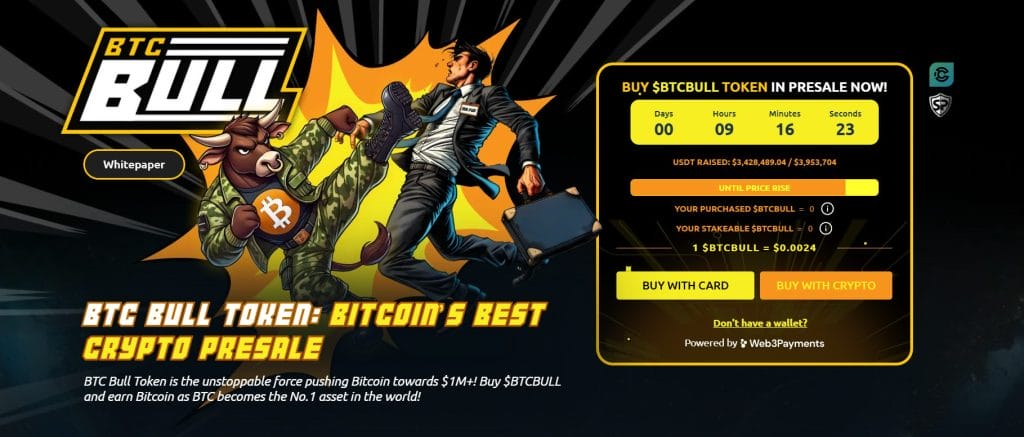

In the midst of market volatility, innovative projects like BTC Bull ($BTCBULL) are emerging as attractive alternatives for investors. This community-driven token rewards holders with real Bitcoin, setting itself apart from conventional meme tokens. The BTCBULL model involves automatic BTC airdrops when Bitcoin reaches significant price milestones, providing a unique incentive for long-term investors.

Additionally, BTC Bull offers high-yield staking opportunities, with an enticing annual percentage yield (APY) of 154%. This appealing staking system has attracted considerable community engagement and participation, with millions of BTCBULL tokens actively staked.

Current Presale Price: $0.0024 per BTCBULL

Total Raised: $3.4M out of a $3.66M target

Conclusion: Navigating a Complex Landscape

As Bitcoin navigates this tumultuous landscape, characterized by shifting economic indicators and government policies, investors find themselves at a crossroads. Will this downturn present a golden opportunity for savvy traders, or are we facing further challenges ahead? The next few weeks will be crucial in determining the fate of Bitcoin and the broader cryptocurrency market. Engage with us in the comments: how are you positioning your investments amidst the current uncertainties?