Bitcoin: The Digital Gold That’s Still Tied to Risk

For years, Bitcoin has been dubbed the “digital gold,” a stalwart alternative for investors seeking protection against geopolitical strife and economic turbulence. However, recent discussions suggest that this may be more of a dream than reality. In a thought-provoking interview with Cryptonews.com, Garrison Yang, co-founder of Web3 development studio Mirai Labs, shed light on Bitcoin’s troubling correlation with traditional financial markets, raising questions about its effectiveness as a hedge against macroeconomic instability.

Why This Matters: The Correlation Dilemma

Investors turned to Bitcoin with the hope that it would behave differently from traditional assets, especially during turbulent times. But what happens when Bitcoin moves lockstep with equities, undermining its reputation as a reliable safe haven? Yang argues that to solidify its place as a genuine hedge against economic challenges, Bitcoin must sever its ties to the movement of U.S. stocks and other risk assets.

Currently, the dynamics are clear: Bitcoin’s value is sensitive to shifts in investor sentiment regarding traditional markets. This isn’t merely a theoretical consideration; it has tangible implications for how Bitcoin might react to future financial crises.

Breaking Down the Correlation: The Numbers Behind the Trend

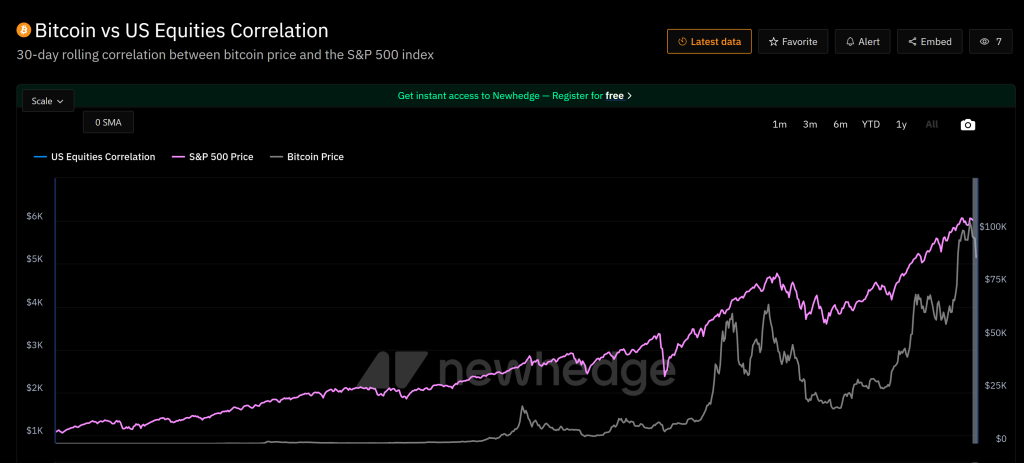

The data paints a revealing picture. Recent statistics from Newhedge indicate that the 30-day rolling correlation between Bitcoin and the S&P 500 has surged, showcasing a strong correlation that raises eyebrows. Following this trajectory, Bitcoin is not yet the bastion of stability that advocates dream it could be; instead, it largely mirrors the volatility of risk assets. Yang asserts that this trend isn’t likely to reverse anytime soon, especially as global markets continue to grapple with inflation and significant financial uncertainties.

Price Plummets and ETF Volatility: A Recipe for Chaos

An added layer of complexity derives from the recent unpredictability surrounding Bitcoin exchange-traded funds (ETFs). Beginning February 18, Bitcoin ETFs experienced a staggering outflow of over $3.2 billion, marking an eight-day stretch of investor withdrawals as the digital asset’s price dipped. Following this period, some relief came with a modest inflow of $94.34 million into spot Bitcoin ETFs on February 28. Yet, recent trends indicate ongoing withdrawals.

Yang suggests this situation may merely be a temporary lull rather than a significant pivot in market perception. As Bitcoin approaches its previous high, a “fair value” price comes into sharper focus, suggesting that institutional investors may be more influenced by Bitcoin’s price trajectory than by sentiment shifts in traditional markets.

Understanding the Bonds: The Hidden Dynamics

While Bitcoin’s volatility can be alarming, another crucial player is the bond market. As investors shift towards “risk-off” assets, equity markets may see a sharp decline that could pull Bitcoin down, potentially to the $70,000 range. Historically, periods where capital flows into safer assets have coincided with downturns for speculative markets.

Yang emphasizes that increases in bond prices could have serious repercussions for Bitcoin and other risk assets, further embedding it in the conventional financial landscape.

Political Influences: A Double-Edged Sword

Surprisingly, political landscapes can also impact Bitcoin’s price action in significant ways. For example, former President Donald Trump’s recent efforts to create a “Crypto Strategic Reserve” sparked interest in the market, yet many investors remain cautious about the proposal’s viability. The potential creation of a national Bitcoin stockpile raises questions that traders are understandably hesitant to answer without clarity.

In contrast, economic policies such as tariffs have a more direct and palpable effect on market sentiment. This interplay becomes critical as Bitcoin’s ability to decouple from traditional assets appears more complex.

What’s Next? The Upcoming FOMC Meeting

The future of Bitcoin could hinge on the upcoming Federal Open Market Committee (FOMC) meeting in March, which many analysts believe may affect Bitcoin’s longer-term trajectory. The market is currently anticipating three rate cuts for 2025, suggesting a potential strategy to weaken the dollar and curb inflation. However, the Fed’s policy direction remains uncertain.

Should the Fed adopt a hawkish stance, Bitcoin may witness substantial corrections. Conversely, a dovish approach with aggressive rate cuts could rekindle bullish momentum, sending ripples throughout the broader crypto market.

Conclusion: A Sector in Flux

As we navigate this dynamic environment, it’s clear that the relationship between Bitcoin, equities, and macroeconomic factors is far more intricate than many imagined. Investors are challenged with the reality that Bitcoin, despite its promise, still carries significant risks similar to traditional assets.

Will Bitcoin ever break free from the shackles of market sentiment, or is it destined to remain a speculative play? Share your thoughts in the comments below—let’s keep the conversation going!