Ripple’s XRP: Navigating Challenges and Opportunities

In the ever-evolving world of cryptocurrency, few events can send ripples through market sentiments like regulatory announcements. While speculation buzzed earlier this week about XRP being considered a strategic crypto reserve asset in the U.S., today’s crypto summit pivoted the focus solely to Bitcoin. This unexpected shift has contributed to a notable decline of 2.36% in XRP’s price. However, despite this recent pullback, XRP continues to exhibit resilience, with an impressive gain of 23.55% over the course of the week. With momentum gathering, can XRP capitalize on this turbulence for a breakout?

XRP Price Analysis: Is $10 Within Reach?

Today’s market dynamics momentarily threatened the stability of XRP’s symmetrical triangle pattern that has been in formation since mid-January. Nevertheless, the bullish structure remains intact, with the daily candle dipping below the upper resistance but bouncing back from a crucial support zone between $2.20 and $2.40. This area has historically been a significant pivot point for XRP’s price movements.

Previous breakout attempts have faltered, yet current technical indicators are suggesting a more robust potential for this one. The Relative Strength Index (RSI) has recently recalibrated to a neutral 50 after retreating from the overbought area at 70, signaling that the market could be ready for a fresh uptick. Furthermore, the MACD line is projected above the signal line, indicating a bullish trend is emerging.

If these positive indications play out, analysts forecast a target price for XRP at $3.85, representing a substantial 53% gain from its current levels. Could this be the first step towards reaching the much-anticipated $10 mark?

Why This Matters: The Ripple Effect of Regulatory Changes

Understanding the implications of regulatory discourse, especially in the U.S., is crucial for crypto enthusiasts and investors alike. The shift away from XRP in the strategic asset conversation may suggest a more cautious approach towards altcoins, which could influence investor confidence across the board. As Bitcoin continues to dominate the narrative as the go-to crypto, the fate of promising altcoins like XRP hangs in the balance.

🔥 Expert Opinions: Insights from Market Analysts

Market analysts are closely observing XRP’s movements, with many expressing optimism. A notable analyst suggests that if XRP can maintain its support above $2.20, we could witness an aggressive climb upwards. “The resilience displayed around the support zones tells us buyers are willing to step in, which is a promising sign for an upcoming bullish breakout,” the analyst noted.

🚀 Future Outlook: What Lies Ahead for XRP?

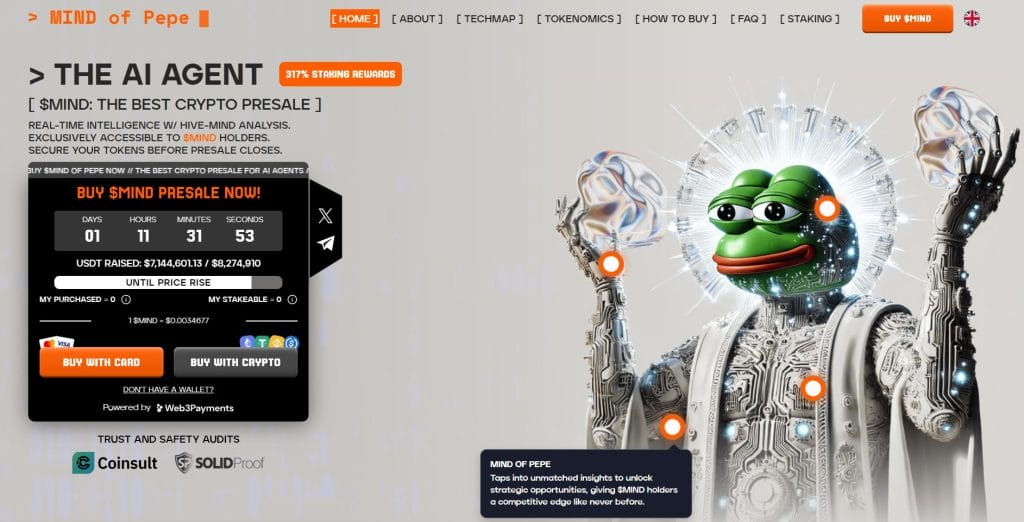

The cryptocurrency space is highly unpredictable, yet it’s also brimming with opportunities. 2025 is shaping up to be a pivotal year, particularly for those involved in meme coins and innovative projects. Among these is MIND of Pepe ($MIND), which is not just an exciting proposition but also offers a structured path for community engagement and investment insights.

As of now, MIND of Pepe has successfully raised over $7.1 million during its presale, positioning itself as a compelling alternative for those looking to capitalize on emerging trends within the crypto landscape.

Conclusion: Engage and Explore

As XRP navigates through a mix of challenges and opportunities, investors are left pondering: will this resilient altcoin break through its resistance levels and set the stage for a price surge? With promising technical indicators and a focus on the evolving regulatory landscape, there’s much to keep an eye on. Are you ready to engage with the future of crypto? Let us know your thoughts in the comments! Together, let’s explore the ever-changing world of cryptocurrency investment.