The digital euro proposed by the European Central Bank (ECB) has been criticized for its complexity, limited benefits, and potential to weaken the competitiveness of European payment systems, according to an August 2024 study. Commissioned by the Association of German Cooperative Banks (BVR) and conducted by payment consultancy Paysys, the study raises significant concerns about the proposed digital currency.

The research team, led by Paysys CEO Hugo Godschalk along with professors Malte Krüger and Franz Seitz, thoroughly examined all relevant documents and regulatory proposals from the Eurosystem and the European Commission up until June 2024. Their analysis focused on the digital euro’s practicality and alignment with the European financial market, particularly from the perspectives of retailers and consumers.

Digital Euro: Overly Complex and Costly

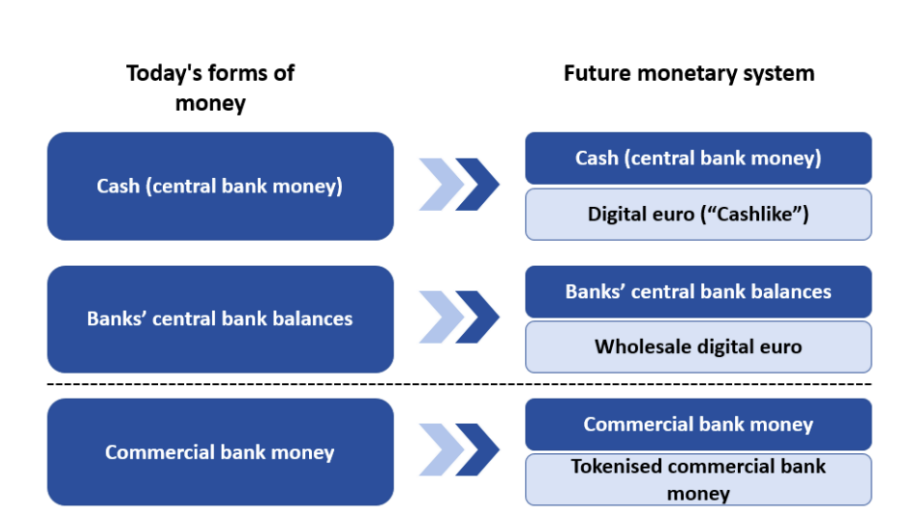

The study’s researchers concluded that the digital euro, as currently proposed, offers minimal added value for consumers and businesses. They argue that the design is overly complex and difficult to understand for both users and merchants. “For instance, the number of parties involved in a payment transaction would increase from the current four (payer, payee, and their respective payment service providers) to as many as eight, complicating and slowing down the settlement process,” the experts noted.

This increased complexity could result in slower and more expensive transactions. The study suggests that the low-cost objectives set by the ECB and EU policymakers are unrealistic and could hinder Europe’s competitiveness.

Professor Malte Krüger of the Technical University of Aschaffenburg, one of the study’s authors, pointed out that the digital euro, as currently designed, would mainly compete with existing cashless payment methods rather than acting as an innovative alternative to physical cash. He also highlighted many unresolved questions and inconsistencies between the ECB’s documentation and the EU Commission’s regulatory proposals.

No Full Anonymity for the Digital Euro

The European Central Bank (ECB) has made it clear that the digital euro will not offer full anonymity. Although the digital euro may support offline use, all users will still be required to complete an identification process during onboarding.

This requirement ensures that the digital euro aligns with existing European Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations, similar to those governing traditional payment accounts. While there could be some leeway for simplified due diligence in certain low-risk scenarios, complete anonymity will not be permitted.

The study suggests that instead of mandating user identification, focusing on transaction monitoring for offline digital euros could be a more effective strategy for AML/CFT compliance while preserving user privacy. The researchers argue that this approach would also simplify the system overall and allow for the introduction of inter-PSP fees to compensate service providers.

Eine vom BVR beauftragte Studie „Der digitale Euro aus Sicht des Verbrauchers, des Handels und der Industrie“ unterzieht die bislang vorliegenden Ideen zur Ausgestaltung eines digitalen Euro einem Realitätscheck. Zur Studie: https://t.co/1kGT7ii1JU pic.twitter.com/lV8C5ZaNfq

— BVR (@BVRPresse) August 6, 2024