New research by Chainplay highlights the alarming mortality rate of meme coins, revealing that 97% of projects launched since 2024 have failed.

Once dismissed as mere internet jokes, meme coins like Dogecoin (DOGE) and Pepe (PEPE) have skyrocketed in popularity, making the sector the fourth most valuable in the crypto space. However, beneath the excitement lies a highly volatile and risky market.

A new report titled “State of Memecoin 2024,” conducted by Chainplay, a hub for GameFi market data, offers a sobering view of the meme coin industry. Published on August 13, the research analyzed over 30,000 meme coin projects across Ethereum (ETH), Solana (SOL), and Base.

The findings reveal a short and turbulent life cycle for meme coins. On average, these coins last only a year, compared to the three-year lifespan of other crypto projects. Alarmingly, 97% of meme coins have already failed, with more than 2,000 disappearing each month. This high turnover rate underscores the speculative nature of these assets, as nearly 60% of investors consider them short-term bets.

🚨 State of Memecoin 2024: High Risk, High Reward 🚨

— ChainPlay.GG (@Chainplaygg) August 6, 2024

Memecoins: A rollercoaster of fortunes or a financial minefield? Our latest study of 30,000 projects unveils the shocking realities behind the hype.

Key findings:

⚰️97% of memecoins have died since 2024

⏳Average lifespan:… pic.twitter.com/rOvHreXq8X

The study also revealed that meme coin projects from 2020 are fading rapidly, with an average of 20 projects dying each month. This decline is largely due to new projects struggling to gain traction and sustain themselves in a crowded market.

Chainplay identified dead meme coins based on four key criteria: a 24-hour trading volume below $1,000, no Twitter updates for three months, a liquidity pool under $50,000, or a deleted Twitter account.

Malicious Actors in the Meme Coin Sector

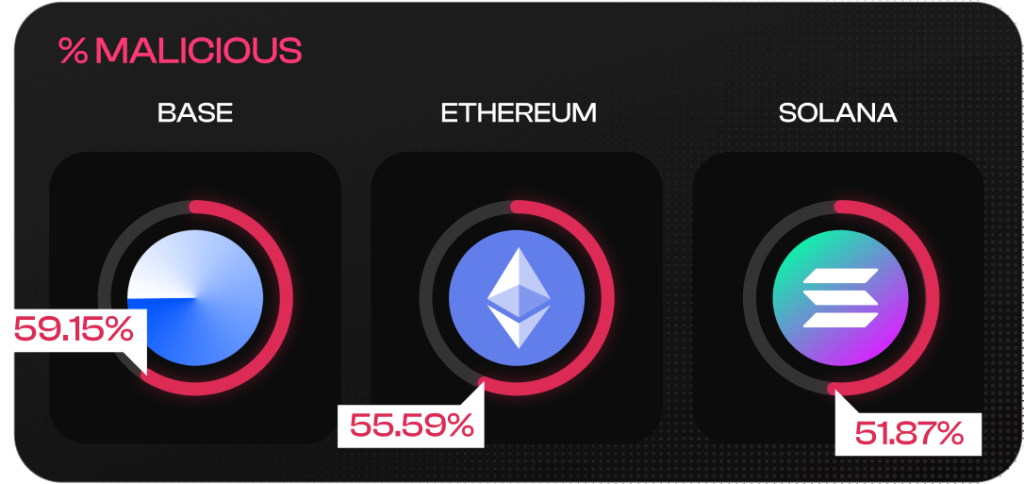

The research also highlighted the concerning prevalence of scam activity within the meme coin market. Over half (55.24%) of all meme coins analyzed were classified as “malicious.” Base had the highest rate of malicious meme coins at 59.15%, followed by Ethereum at 55.59%, and Solana at 51.87%.

The report also underscores the financial risks tied to these digital assets. Nearly one-third of investors (28%) surveyed admitted to falling victim to meme coin scams. However, audit reports have proven to be a valuable tool in identifying fraudulent projects, boasting an 81% success rate in doing so.

Meme Coins Remain Popular with Investors

Despite the inherent risks and volatility, meme coins continue to captivate a large segment of the crypto community. The study found that 58% of cryptocurrency investors have dabbled in the meme coin market, lured by the promise of potentially high returns.

Interestingly, the report notes a split in investor sentiment based on experience. Newer investors, particularly those in the market for less than six months, are more likely to see meme coins as crucial to their portfolios, while long-term investors tend to approach these assets with greater caution.

Media coverage of meme coins generally reflects this caution, with only 13.77% of news reports displaying a bullish outlook on the sector. This skepticism highlights the broader concerns surrounding the industry’s risks.

Pump.fun Achieves Record Revenue

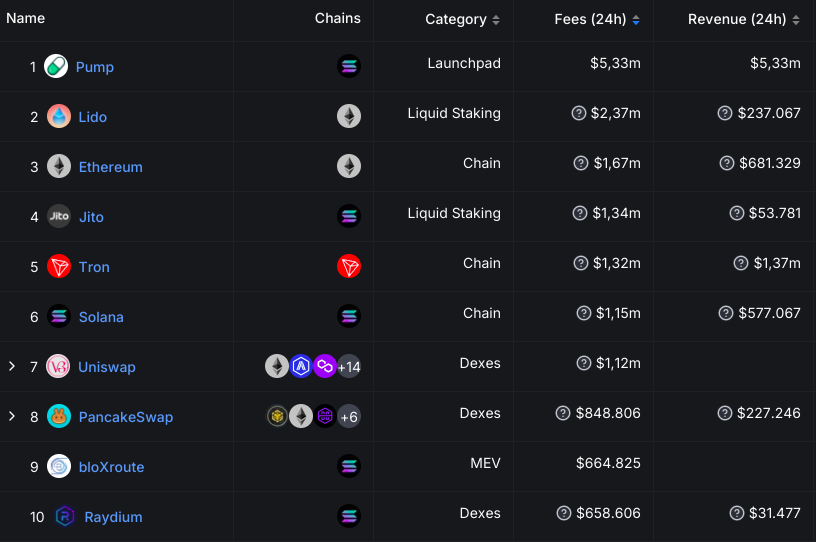

Despite the high failure rate of meme coins, interest in these assets remains robust. Pump.fun, a Solana-based meme coin deployer, recently generated over $5.3 million in revenue within 24 hours, as reported by DefiLlama data. This highlights the ongoing enthusiasm and speculation in the meme coin market, even amid its challenges.

Pump.fun’s impressive revenue outstripped that of well-established blockchain networks like Ethereum and Solana, which reported combined revenue and fees of $2.35 million and $1.72 million, respectively. This stark contrast highlights the intense interest and speculation surrounding meme coins, despite their high risk and volatility.