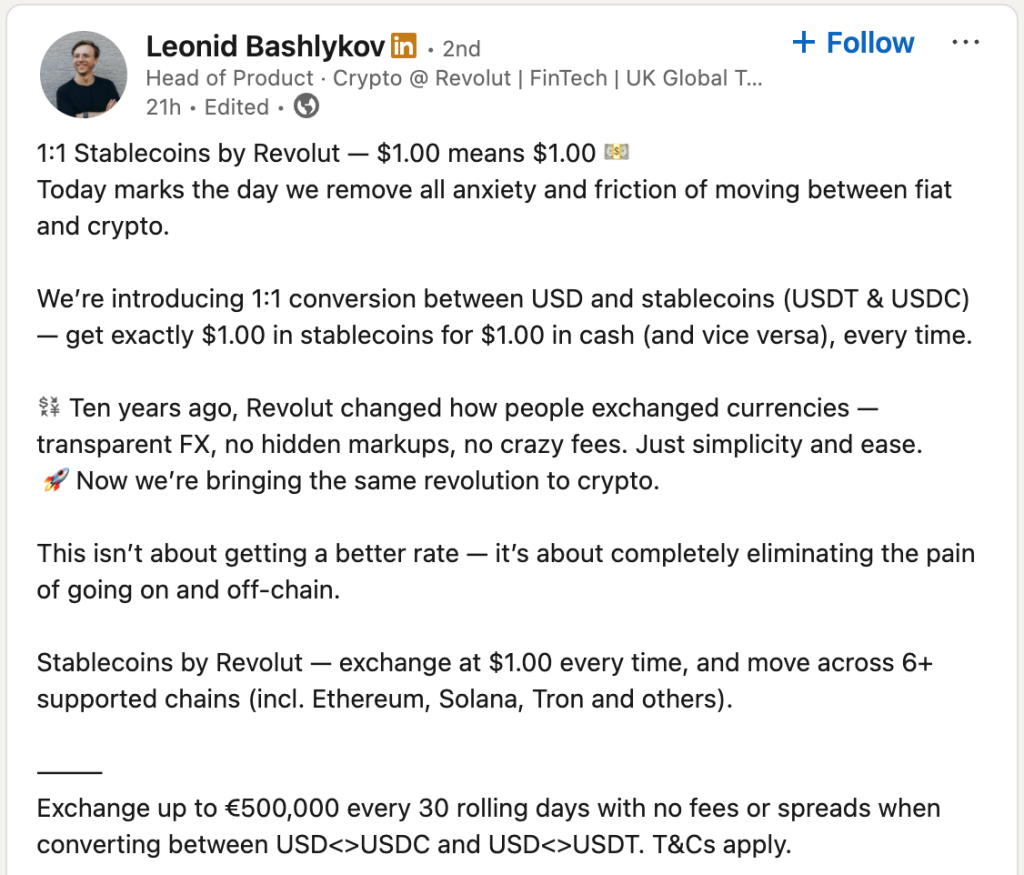

In a groundbreaking move that has the potential to reshape the way cryptocurrency enthusiasts and investors engage with digital assets, Revolut has unveiled a game-changing feature that eliminates fees and spreads when converting between the US dollar and two major stablecoins, USDT and USDC. This innovative offering allows Revolut’s thriving community of 65 million users worldwide to exchange up to €500,000 every 30 rolling days with the confidence of exact 1:1 rates. This development not only simplifies the transition between fiat and crypto but also echoes Revolut’s ten-year legacy of making currency conversion seamless for customers. Could this be the turning point that makes cryptocurrency more accessible to the masses?

Leonid Bashlykov, the Head of Product Crypto at Revolut, announced this exciting new feature on LinkedIn, where he highlighted a critical point: users will receive exactly $1.00 in stablecoins for every $1.00 in cash and vice versa. This precise parity is crucial because it alleviates the traditional pain points associated with trading, where users often lose money to hidden charges.

The service brings a wave of ease, supporting transfers across six prominent blockchain networks, notably Ethereum, Solana, and Tron. By eliminating the typical markup imposed by exchanges and trading platforms, Revolut is effectively creating a frictionless on-ramp and off-ramp for its users, ushering in a new era of accessible cryptocurrency trading. In a world where transparency is often lacking, this level of clarity and convenience is a breath of fresh air.

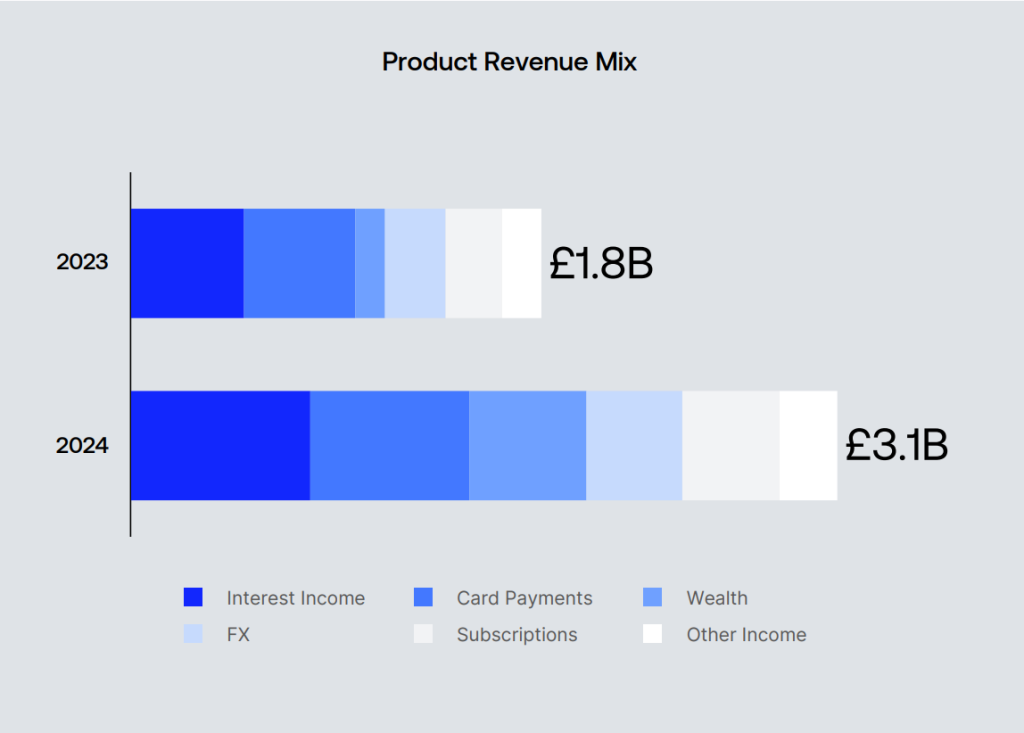

As the cryptocurrency landscape continues to evolve, Revolut appears to be riding the wave effectively. To further contextualize this leap, consider that Revolut’s wealth division, which encompasses a wide range of services including cryptocurrency trading, commodities, and savings products, reported a staggering £506 million in revenue for 2024. This represents a phenomenal 298% increase year-over-year—a statistic underscoring the growing interest and participation in cryptocurrency. The surge in revenue can be largely attributed to heightened trading activity, propelled by the successful launch of Revolut X in May 2024.

Revolut X, designed specifically for professional traders, allows users to engage with over 100 different tokens, with impressively low fixed fees—0% for makers and a mere 0.09% for takers, irrespective of trading volume. This positions Revolut X as a formidable player in the competitive landscape of cryptocurrency exchanges, especially as the platform expands its reach to an additional 30 European countries, equipping traders with real-time capabilities, advanced analytics, and integrated TradingView charts to enhance their trading experience.

As the fintech giant moves forward, its figures paint a compelling picture: Revolut surpassed $1 billion in annual profit for the first time in 2024, with net earnings climbing to £1.1 billion, reflecting a 149% increase from the previous year. Total revenue surged by 72% to £3.1 billion, with subscription services enjoying a 74% boost to £423 million and a remarkable 86% growth in the loan book, reaching £979 million. Such impressive growth signals a positive trajectory as Revolut prepares for a significant leap into full banking operations in the UK, following the approval of a restricted banking license in July 2024.

As Revolut innovates, they are also actively expanding their strategic partnerships. The introduction of Revolut Ramp in March 2024, in collaboration with Consensys, empowers users by allowing them to purchase cryptocurrencies directly within their Web3 wallets. Further partnerships, like the one with Ledger announced in August, enable customers to buy cryptocurrencies using their Revolut accounts through Ledger Live, enhancing user convenience. With most customer funds stored in cold storage and robust security measures in place, such as 24/7 encrypted chat support and cutting-edge risk monitoring tools, security is a top priority for Revolut.

🏦 @RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence.#Revolut #Fintech

Looking ahead, Revolut is not resting on its laurels. With aspirations to acquire banking licenses in ten additional countries and plans to invest over €1 billion in France by 2028—including establishing a Western European headquarters in Paris—the company is poised for ambitious growth. Furthermore, Revolut is eyeing a potential acquisition of a US nationally chartered bank, which would expedite its entry into the complex American banking market. As it stands, Revolut serves a global clientele of 60 million, with 12 million based in the UK. However, crypto services remain on hold in the United States due to ongoing regulatory uncertainties since October 2023.

Revolut’s founder, CEO Nik Storonsky, recently secured a substantial secondary investment in 2024 at an impressive valuation of $45 billion, with whispers of a further $1 billion fundraising round potentially elevating the company’s valuation to around $65 billion. This would pave the way for a dual listing in London and New York, a move that could place Revolut among the top 15 most valuable firms on the London Stock Exchange while leading to its historic simultaneous joining of the FTSE 100 and a listing in New York. With such aspirations, Revolut is undoubtedly steering towards a thrilling future in the financial landscape.

The question is, what does this mean for you? As cryptocurrency continues to find its footing in the world of mainstream finance, tools like those offered by Revolut are making it easier than ever for both new and seasoned traders to navigate the digital currency landscape. Will Revolut’s innovative approach encourage wider adoption of cryptocurrencies and reshape our approach to finance? Only time will tell.