In a strategic maneuver that has garnered significant attention in the cryptocurrency and real estate sectors, Cardone Capital has taken a bold step by adding another 130 Bitcoin to its balance sheet. This move not only reinforces the company’s commitment to integrating digital assets with real estate investments, but it also exemplifies a growing trend where blockchain technology meets traditional finance. Let’s dive deeper into the implications of this development and what it means for the future of both industries.

Cardone Capital’s latest Bitcoin acquisition comes during a refinancing of its Miami River property. Instead of opting for conventional tactics like purchasing interest rate caps, the firm decided to raise equity and utilize it to reduce debt while simultaneously enhancing its Bitcoin holdings. As Grant Cardone, the firm’s Chief Executive, pointed out, the project’s Fannie Mae debt has been locked at a competitive rate of 4.89%. This marks Cardone Capital’s fourth transaction involving Bitcoin, and with eight additional deals in the pipeline, it illustrates a clear consolidation of both digital and physical assets.

Cardone Capital adds another 130 bitcoin completing its Miami River refinance. Rather than buying rate caps, we raised equity to pay down debt & added 130 BTC. Fannie debt was locked at 4.89%This is Cardone Capital’s 4th transaction adding BTC to its Real Estate investments with 8 more upcoming! @GrantCardone August 19, 2025

This latest expansion follows Cardone Capital’s notable announcement in June when it acquired an impressive 1,000 Bitcoin, valued over $101 million at market rates. Grant Cardone boldly labeled this move as the “first ever real estate/Bitcoin company integrated with a full BTC strategy.” His vision combines multifamily housing—a long-standing investment staple—with the innovative potential of Bitcoin, creating a unique investment framework that appeals to a diverse range of investors.

With aspirations to accumulate a staggering 4,000 Bitcoin within the year, Cardone Capital aims to position itself among the top non-mining corporate holders of this digital asset. Established in 2017, the firm manages a portfolio of more than 14,000 multifamily units nationwide, boasting assets worth approximately $5.1 billion. The revolutionary idea of pooling resources from both accredited and non-accredited investors to acquire large-scale residential properties reflects the evolving landscape of investment strategies in today’s economy.

Earlier this year, Cardone Capital also launched the 10X Miami River Bitcoin Fund, a dual-asset vehicle that combines the tangible value of real estate with $15 million in Bitcoin, further emphasizing its commitment to innovative investment forms. Cardone characterizes this strategy as a hedge against inflation and a proactive alternative to traditional treasury management. Investing in Bitcoin alongside income-generating real estate offers a compelling store of value, appealing to many in the business community and beyond.

🔥 The reaction within the industry has been overwhelmingly positive. Notably, MicroStrategy’s Michael Saylor, a leading advocate for Bitcoin in corporate finance, praised Cardone for his groundbreaking efforts to integrate cryptocurrency into the real estate arena. This endorsement indicates a potential shift in how businesses may view digital assets as viable financial tools for the future.

As Cardone Capital pioneers this intersection of digital and traditional finance, it sits amid a larger narrative: the global corporate race to accumulate Bitcoin, with companies like Japan’s Metaplanet significantly boosting their holdings. Recently, Metaplanet reported adding 775 Bitcoin to its reserves, bringing its total to an impressive 18,888 coins, worth about $2.18 billion. Such aggressive strategies place Japanese firms on the map in the corporate Bitcoin ownership landscape, mirroring the approach taken by MicroStrategy.

💰 @Metaplanet_JP has boosted its Bitcoin reserves to 18,888 BTC worth about $2.18B after adding 775 coins, continuing its aggressive treasury strategy. #Metaplanet #BitcoinTreasury @Cryptonews August 18, 2025

Meanwhile, the expansion is not just limited to single entities. The landscape is burgeoning with interest. Other Japanese companies are unveiling plans to engage in Bitcoin acquisition to guard against inflation and support their growth strategies. Alliance with Bitcoin is becoming increasingly popular, as companies like Lib Work plans to invest $3.3 million in the digital asset, demonstrating how widespread adoption continues to rise.

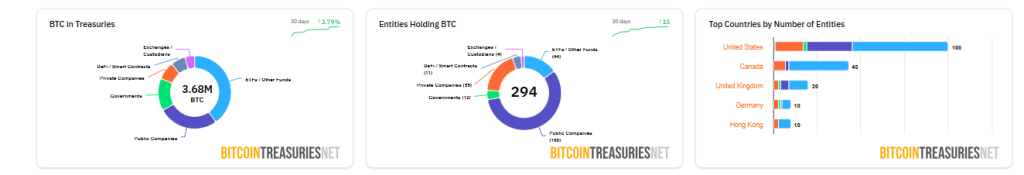

As we analyze trends in corporate Bitcoin treasury strategies, figures reveal that a collective of 294 entities currently holds 3.68 million Bitcoin, accounting for roughly 18% of the circulating supply. More governmental bodies, including the U.S. administration, are now recognizing Bitcoin as a strategic reserve asset, bolstered by announcements of future “Strategic Bitcoin Reserves” being created from confiscated assets.

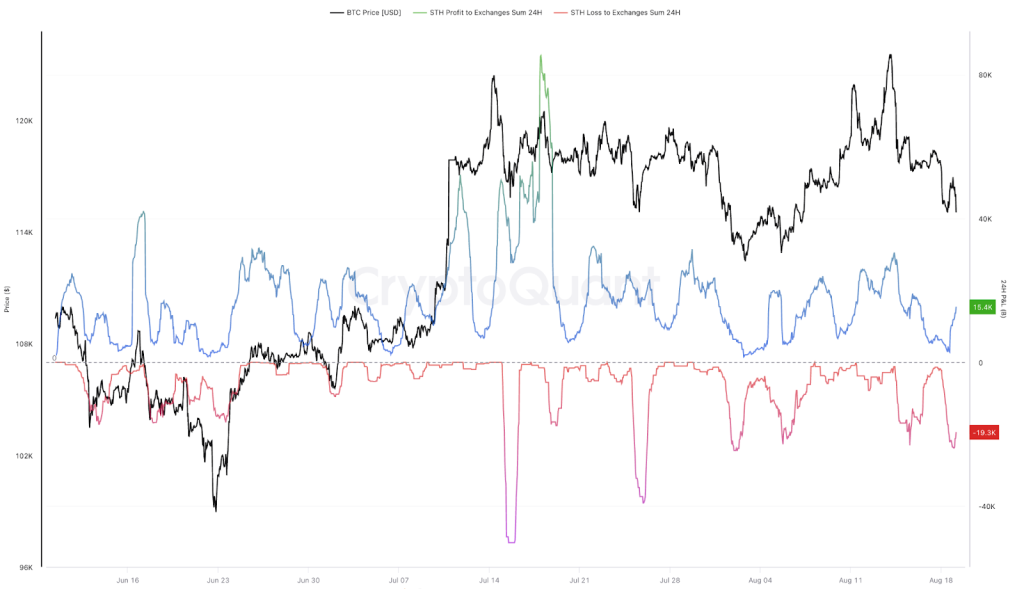

Currently, Bitcoin’s price has seen fluctuations, with the market cooling down from record highs, recently trading below $116,000 after hitting peaks of $124,500. Analysts point out that recent behaviors among short-term holders may foreshadow deeper corrections or set the stage for an impending rally as the market adjusts.

The landscape is shifting dramatically as Bitcoin matures and integrates deeper into the fabric of our economic systems. With Cardone Capital leading the charge in intertwining real estate and cryptocurrency, the business world is watching closely to see how these innovative strategies will unfold. Will we see a future where digital assets and tangible investments are standard practice? Only time will tell, but for now, the momentum is strong, and many are joining the race toward a more integrated financial environment.

As we continue to navigate these developments, we encourage you to stay informed and consider the evolving dynamics of investments in this new digital era. What are your thoughts on the intersection of cryptocurrency and traditional assets? Share your views, and let’s keep the conversation going!