In a remarkable turn of events for the Indian cryptocurrency exchange WazirX, a stunning 95.7% of creditors have rallied behind the latest restructuring proposal. As anticipation builds, the plan now awaits the all-important nod from the Singapore High Court. This restructuring scheme comes in the wake of a significant hacking incident that left the platform grappling with severe financial losses.

📢 Update on Amended Scheme of Arrangement Revote95.7% of voting Scheme Creditors supported the Amended Scheme of Arrangement. The Amended Scheme was also supported by 94.6% of associated Approved Claims. This outcome reaffirms the strong support shown in the first round of… pic.twitter.com/hVCZqRXIuZ— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) August 18, 2025

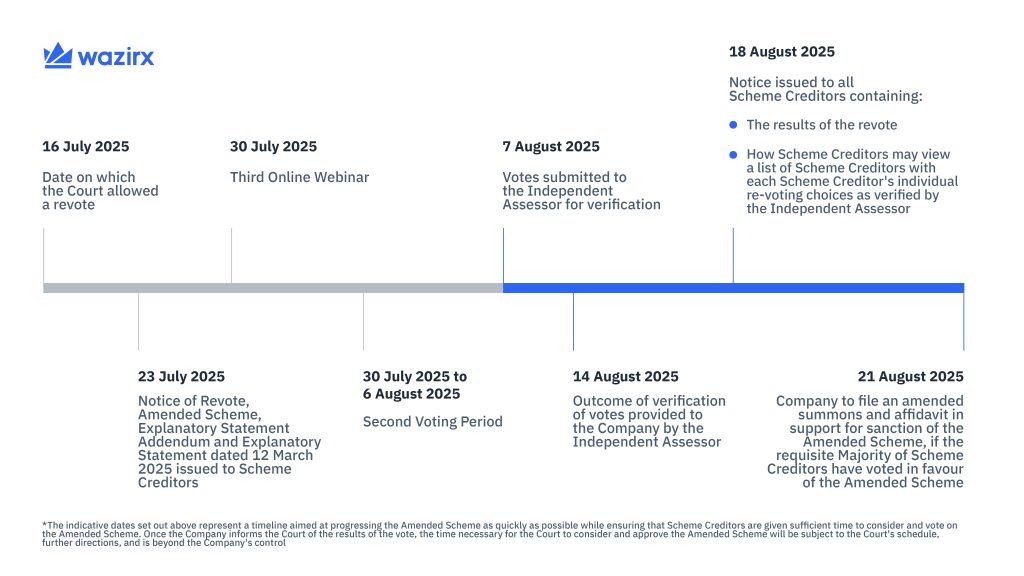

The successful vote, coordinated by WazirX’s parent company Zettai Pte Ltd, involved the participation of a considerable number of creditors—from July 30 to August 6, only those maintaining positive balances as of July 18, 2024, were eligible to cast their votes. Out of 149,559 creditors, who represented claims totaling approximately $206.9 million, an overwhelming majority of 143,190 creditors, accounting for $195.7 million, showed their support. This not only meets but surpasses the statutory requirements under the Singapore Companies Act 1967.

WazirX’s founder Nischal Shetty has expressed optimism, stating that this new restructuring blueprint aims to kickstart operations and restore trading activities within a swift timeframe—just ten business days following the scheme’s approval. This renewed confidence among creditors highlights their belief in the platform’s ability to recover and thrive once more.

This favorable outcome follows a previous setback when an earlier restructuring proposal was dismissed due to concerns of equity and feasibility, despite also enjoying creditor support. Notably, during that period, creditors voiced frustrations about asset recovery processes, alleging mismanagement. Time will tell if WazirX can truly turn the tide following these developments.

The urgency of this matter is magnified by the infamous hacking incident in July 2024, attributed to North Korea’s Lazarus Group, which culminated in losses exceeding $230 million—about 45% of WazirX’s holdings. Following the hack, Zettai sought creditor protection and acquired a four-month moratorium from Singapore’s High Court to plot out a new course.

While the voting results provide a glimmer of hope, many creditors remain cautious about the timeline for recouping their funds. WazirX has hinted at the prospect of reimbursements potentially stretching as far as 2030, depending on the restructuring’s approval status. This situation lays bare the complexities that cryptocurrency platforms endure in their quest for regulatory compliance and operational stability.

So basically WazirX fund recovery options are: → Trust another WazirX product with your money (again).→ Wait until 2030 to maybe get your funds back in fiat.Is this even real? Absolute joke. pic.twitter.com/WV3XYqyqNe— IshitaPandey.eth (@IshitaaPandey) February 4, 2025

Should the restructuring scheme receive the necessary judicial backing, WazirX has promised a more systematic approach to asset recovery, a much-needed lifeline for anxious creditors. However, if the proposal is rejected, the specter of liquidation looms, likely resulting in diminished recoveries and further uncertainty.

Two paths, two very different outcomes.Here’s a breakdown of what happens if the Scheme is approved versus if it isn’t. Understand what to expect in both scenarios as we approach the voting process. pic.twitter.com/ZcXpC8g79Q— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) February 4, 2025

As we await the court’s decision, this scenario sheds light on the broader challenges within the cryptocurrency landscape, where operational integrity and regulatory frameworks are under constant scrutiny. WazirX’s journey serves as both a cautionary tale and a resilient comeback story, inviting all stakeholders to remain engaged and vigilant in this ever-evolving space.

Ultimately, the success of this restructuring could pave the way for WazirX to regain its foothold in the market, but it will take more than just supportive numbers to foster trust among an understandably skeptical community. Stay tuned as developments unfold and the future of WazirX hangs in the balance!