As Bitcoin (BTC/USD) clings to the $118,000 mark, having recently danced close to its all-time peak of $124,533, cryptocurrency enthusiasts find themselves on an emotional rollercoaster. Although Bitcoin is currently down 0.70% week-over-week, its performance has been nothing short of remarkable compared to gold, which has taken a hit, slipping 1.83% to approximately $3,335 per ounce. This divergence invites an intriguing question: Is Bitcoin eclipsing gold as the go-to safe-haven asset in today’s financial landscape?

Adding his voice to the conversation is Robert Kiyosaki, the renowned author of the bestseller “Rich Dad Poor Dad”, who recently raised alarms about the U.S. stock market. Through a spirited post on X, he warned investors to brace themselves as warning signals for a stock market crash flash red. This precarious situation spells trouble for traditional portfolios, especially for the baby boomers among us who heavily depend on 401(k) retirement plans. Kiyosaki’s advice? Venture beyond stocks and bonds into the realm of “real money.”

Stock market crash indicators warning of massive crash in stocks.Good news for gold, silver, and Bitcoin owners.Bad news for Baby Boomers with 401 k.Take care.— Robert Kiyosaki (@theRealKiyosaki) August 11, 2025

Kiyosaki highlights a trio of assets—gold, silver, and Bitcoin—as the viable bastions against inflation, currency depreciation, and systemic shocks. While he remains quite fond of precious metals, it’s clear that his enthusiasm for Bitcoin is at an all-time high. He describes Bitcoin as “the people’s money,” noting its inherent digital scarcity and the accessibility it offers, free from government constraints.

In an age where crises loom large, one might wonder if Bitcoin presents a safer alternative to gold. Traditionally, gold has reigned supreme as the ultimate hedge against economic turmoil. However, Kiyosaki argues that Bitcoin has an edge in today’s volatile environment. With fiat currencies facing backlash and central banks bloating their balance sheets, he boldly predicts that Bitcoin could skyrocket to $1 million if confidence in traditional monetary systems continues to wane.

Robert Kiyosaki is sounding the alarm again 🚨—he’s predicting a massive stock market crash and says traditional retirement plans like 401(k)s could take a serious hit. His advice? Ditch the paper assets and go for “real money” like gold, silver, and especially Bitcoin. 💰He’s… pic.twitter.com/yRmdO6Gn5s— Seven Crypto 🐋 (@SevenWinse) August 17, 2025

Kiyosaki has drawn a captivating comparison between his experiences in real estate and the explosive gains he’s witnessed with Bitcoin, remarking that accruing wealth via this digital currency has been far less cumbersome than years spent dealing with property markets. He refers to Bitcoin as a “genius asset design,” yet poses a thought-provoking question: If Bitcoin can create wealth rapidly, why are so many individuals still struggling financially?

His strategy for hedging against economic downturns is comprehensive, incorporating not just Bitcoin but also gold, silver, oil, and cattle. With Moody’s recent downgrade of U.S. bonds and a noticeable increase in Asian demand for gold, Kiyosaki believes the traditional safe havens are under unprecedented strain. Sticking to conventional assets, he cautions, could lead to significant losses when markets inevitably shift.

- Bitcoin recently peaked at $124,533 before consolidating around $118,000.

- Gold has lagged, dropping nearly 2% over the same timeframe.

- Kiyosaki sees Bitcoin as “the people’s money” with a potential to reach $1 million.

- He issues a warning to baby boomers about possible steep losses in their 401(k) plans amid an impending crash.

Turning our attention to technical analysis, Bitcoin’s price trajectory appears resilient. The daily charts depict a bullish ascending triangle, buoyed by a rising trendline since June. Currently, BTC trades close to $118,367 with robust daily transaction volume exceeding $44 billion, highlighting strong market engagement. The relative strength index (RSI) registers at 53, indicating potential for further upward movement without overheating, while the moving average convergence divergence (MACD) remains positive, despite a slight cooling of momentum. Recent candlestick patterns point to a period of consolidation below the resistance level of $123,235, reflecting market indecision.

For those trading Bitcoin, the strategy is straightforward: a long position above $123,235 with stop-losses set below $116,700 enhances risk-reward dynamics. Conservative traders may prefer waiting for a retest of the $116,700-$115,600 zone with bullish confirmation before entering the market. As we look ahead, Bitcoin is laying the groundwork for its next significant move. Should bulls successfully breach current resistance levels, heading towards the $130,000 zone, Kiyosaki’s assertion of Bitcoin as a superior safe haven compared to gold may become a widely accepted narrative.

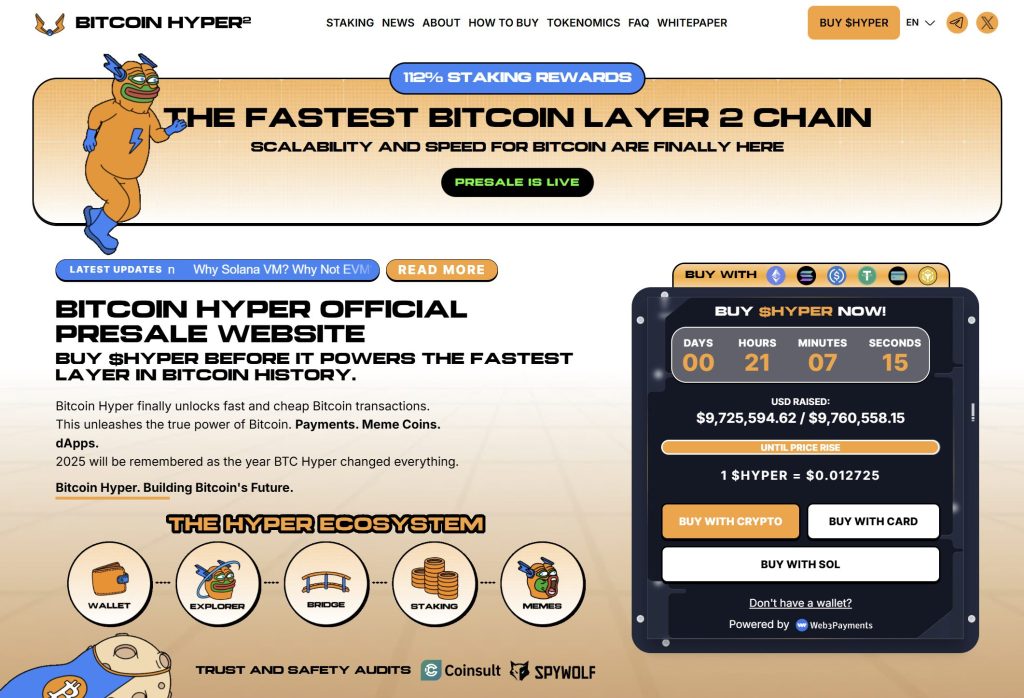

In line with the evolving cryptocurrency landscape, an exciting development has surfaced: Bitcoin Hyper ($HYPER), the inaugural Bitcoin-native Layer 2 solution powered by the Solana Virtual Machine (SVM). This innovation aims to energize the Bitcoin ecosystem with rapid, cost-effective smart contracts, decentralized applications (dApps), and even meme coin creation. By harmonizing Bitcoin’s robust security with Solana’s lightning-fast performance, Bitcoin Hyper introduces a range of new possibilities for users and developers alike.

This project has captured investor interest, with its presale already amassing over $9.7 million, leaving only a limited allocation of tokens remaining. HYPER tokens are currently priced at merely $0.012725, but expect an increase soon. Those eager to seize this opportunity can participate in the presale via the official Bitcoin Hyper website, purchasing HYPER tokens using either cryptocurrency or credit cards. Click Here to Participate in the Presale.

In conclusion, as Bitcoin surges ahead, leaving traditional assets behind in its trail, it becomes crucial for investors to evaluate their strategies. With Kiyosaki’s insights resonating in the echo chamber of financial decline, now may be the time to lean into the transformative potential of cryptocurrencies. After all, the investment landscape is shifting, and those who adapt could very well be the winners in this fast-evolving market.