In the fast-paced world of cryptocurrency trading, excitement is bubbling over as Raydium ($RAY) surges with an impressive 13.7% increase, reaching $3.65! This isn’t just a fleeting moment of hype; traders are enthusiastically diving into this Solana-based decentralized finance (DeFi) standout. With a staggering monthly trading volume of $40 billion and transformative buyback dynamics, Raydium is solidifying its role as a major player in the DeFi arena.

So, what exactly is fueling this rally? Raydium operates as a key automated market maker (AMM) that integrates with Serum’s decentralized order book, creating an efficient liquidity hub for Solana’s DeFi ecosystem. By merging AMM benefits with order book precision, Raydium provides investors with low latency and more efficient trading experiences than standalone protocols.

A significant catalyst behind Raydium’s explosive growth is its LaunchLab platform, dedicated to facilitating new token launches, especially for Solana’s wave of innovative memecoins. Recently, on August 9, LaunchLab accrued around $900,000 in daily protocol fees, surpassing traditional swap revenues while channeling 12% of these earnings into $RAY buybacks. This not only bolsters the asset’s value but also introduces essential deflationary mechanics.

Introducing LaunchLab, Raydium’s all-in-one token launchpad. Built for Creators, Developers, and the Community 🫡 https://t.co/yZVzShVZSJ More info ⬇️

Moreover, Raydium has established itself as the primary liquidity hub for xStocks, which tokenizes equities like Nvidia and Tesla, revolutionizing how traditional finance assets interact with DeFi. Liquidity providers have lucrative incentives, including weekly rewards of up to $14,000 in $RAY tokens, making participation not just innovative but highly rewarding.

Tokenized equities on @SolanaxStocks are bringing Nvidia, Tesla, Circle, Strategy (MSTR), and SPY on-chain, revolutionizing internet capital markets for everyone, everywhere; faster and fairer than the traditional systems. Raydium is the hub for tokenized equities on Solana.

As Raydium continues to carve a niche in the DeFi landscape, its prosperity closely hinges on Solana’s scalability and robust growth trajectory. The looming Firedancer upgrade, anticipated in Q3 2025, aims to escalate Solana’s transaction capacity to over one million transactions per second (TPS). Given that Raydium already dominates 95% of Solana’s tokenized stock trading, such enhancements could make its liquidity pools highly enticing for new projects.

However, the competition is fierce, primarily from Orca DEX, which poses a real threat to Raydium’s market share if it can outpace in facilitating rapid launches or offering lower fees. The dynamics of the market continue to evolve, and July’s impressive performance indicates Raydium’s strong foothold. The protocol reported a remarkable cumulative trading volume of $40.1 billion— a 71% increase from the previous month—and a revenue spike of 137%, totaling $18.33 million, with $5.7 million directed towards $RAY buybacks, leading to a total of 3.45 million tokens repurchased.

Month of July Review: @RaydiumProtocol– $40.1b in cumulative monthly volume, MoM increase of 71%– $18.33m in protocol revenue, MoM increase of 137%– $5.7m allocated to programmatic $RAY buybacks (2.1m RAY) + additional discretionary maker-side buyback of 1.35m RAY (3.45m…

Yet, the question on everyone’s mind is: will $RAY breach the crucial $3.60 resistance towards the $5 mark? That largely depends on how effectively it maintains momentum against the backdrop of ongoing network upgrades and heightened competition.

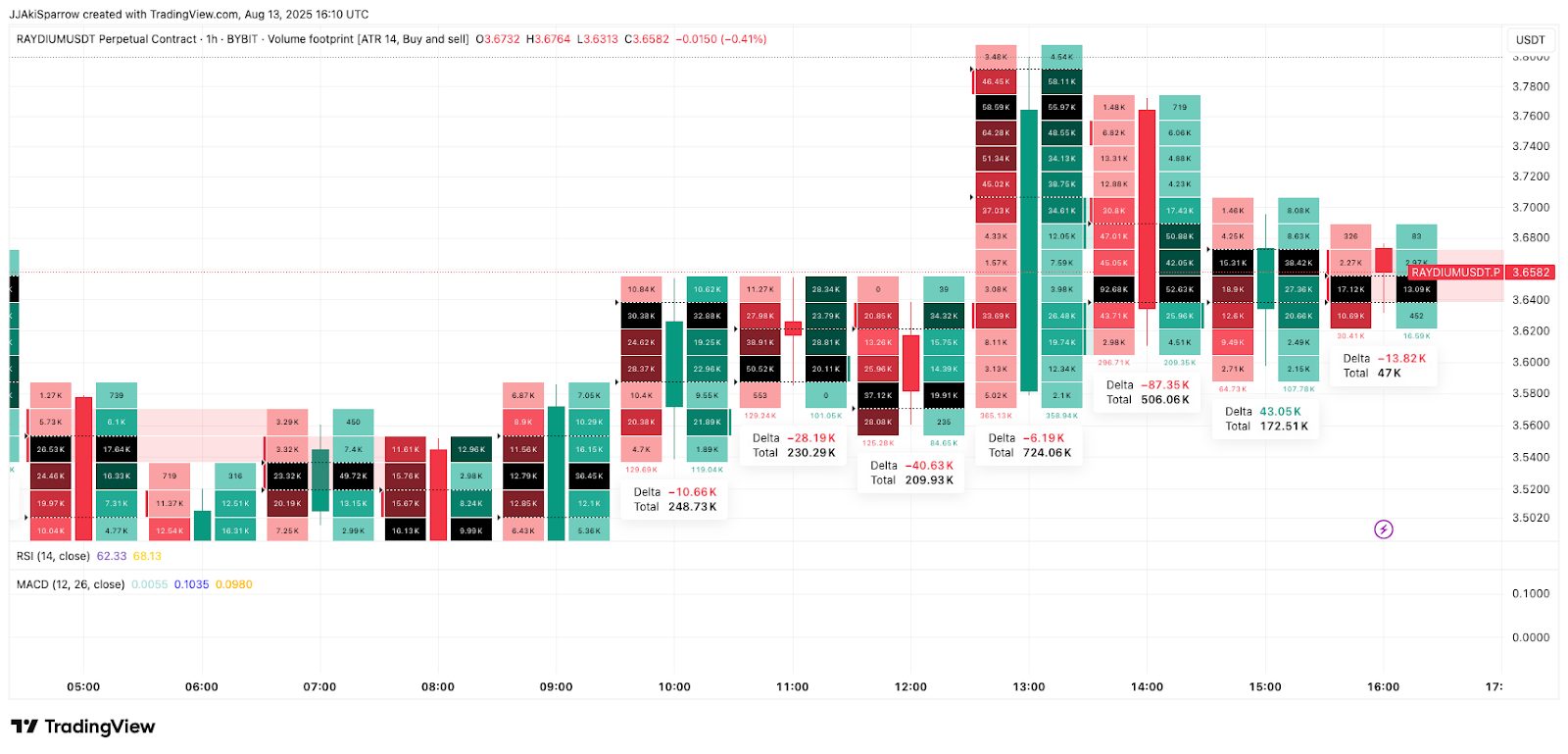

In terms of technical analysis, $RAY’s recent data looks promising. It has established a bullish structure, continuously trading above the breakout level at $3.59 after a vigorous climb from a support zone at $2.98. The hourly charts reveal that this breakout is not just a transient occurrence; it showcases a robust transition facilitated by strong trading volumes and a series of higher lows, reclaiming all major moving averages effectively.

The ascending trend that initiated on August 9 saw the 20, 50, and 100 simple moving averages (SMAs) aligning bullishly. Throughout this period, Raydium’s price movements respected the 20 SMA as a reliable support level, reinforcing bullish sentiment following a minor dip on August 11, affirming buyers’ commitment to maintain control above critical price points.

The breakout past $3.59 carries hefty psychological weight, shifting the market’s sentiment as it transitions to support. Observing the chart, the Relative Strength Index (RSI) reached 68 during this period, demonstrating robust momentum, albeit just shy of overbought territory. Although the MACD histogram showed slight flattening, the line remains above the signal, implying that the bullish trend continues even if the acceleration has paused temporarily.

Moreover, examining $RAY’s volume footprint reveals a persistent buying presence above $3.59, with notable clusters awaiting between $3.62 and $3.68, characterized by aggressive buying and positive delta candles. Despite momentary sell pressure observed during midday sessions, buyers have consistently resurfaced, hinting at a robust demand for this price range.

The defense of this zone signals its importance as a battleground between the rallying bulls and the bearish forces looking to execute a counter-offensive. As long as the volume remains steady and sellers fail to reclaim the $3.59 mark, it seems likely $RAY will continue its upward trajectory, especially if wider market conditions remain stable.

In conclusion, the narrative surrounding Raydium is one of tremendous potential and relentless growth amidst a competitive landscape. As the DeFi ecosystem continues to evolve, $RAY is set to be a significant player, inspiring both traders and investors alike to keep a keen eye on its developments.

Stay informed and engage with the ever-changing dynamics of the cryptocurrency market. Consider following sources like [CoinGecko](https://www.coingecko.com) and [TradingView](https://www.tradingview.com) for updates on price movements and market analysis. Will you seize the next opportunity in the DeFi space? Only time will tell!