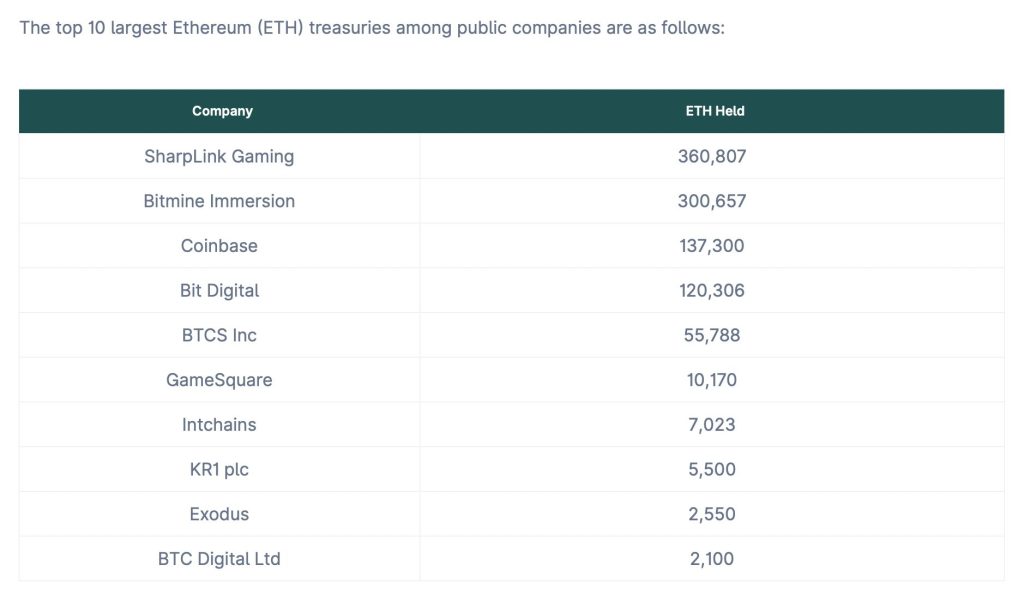

In a significant development in the cryptocurrency landscape, SharpLink Gaming has claimed the title of the largest publicly traded holder of Ethereum. With an impressive 360,807 ETH valued at around $1.33 billion, the company’s strategy showcases a strong commitment to integrating Ethereum into its financial fabric. Most notably, over 95% of SharpLink’s ETH is either actively staked or deployed via liquid staking platforms, a move that fortifies its balance sheet while simultaneously generating yields. This strategic pivot effectively positions Ethereum as a foundational element of SharpLink’s treasury approach.

“Never stop stacking $ETH”

— SharpLink (SBET) (@SharpLinkGaming) July 23, 2025

Trailing closely is BitMine Immersion, a major player in the crypto mining sector, currently holding 300,657 ETH valued at approximately $1.11 billion. Under the leadership of Tom Lee, co-founder of Fundstrat, BitMine has ambitious plans to eventually acquire 5% of the total Ethereum in circulation, setting a lofty target of 6 million ETH. This bold ambition underscores the company’s belief in Ethereum as not just a cryptocurrency, but as a critical infrastructure component of financial ecosystems.

In a recent announcement, BitMine Immersion Technologies revealed that its common stock has begun trading on the New York Stock Exchange under the ticker symbol BMNR. This milestone further exemplifies their commitment to the Ethereum network and its overarching potential in the realm of digital commodities.

Meanwhile, the renowned cryptocurrency exchange, Coinbase Global, Inc., though now in third place, remains a significant player with 137,300 ETH valued at around $507.34 million. Once dominating the ranks as the top ETH holder among public firms, Coinbase has been surpassed yet continues to be a crucial institutional holder, representing about 13.7% of all ETH owned by publicly listed companies.

Not to be overlooked, Bit Digital—recognizable primarily for its Bitcoin mining activities—has also steered a significant portion of its operations toward Ethereum. Currently holding 120,306 ETH valued at $444.54 million, Bit Digital’s embrace of Ethereum’s proof-of-stake model illustrates a diversification strategy aimed at maximizing its financial potential.

As the crypto landscape continues to evolve, smaller but strategic players are also making their mark. For instance, BTCS Inc. has recently boosted its Ethereum holdings to 55,788 ETH, worth about $206.14 million, largely due to a recent acquisition of 22,935 ETH. With a focus on staking and node validation services, BTCS is enhancing its role in the broader blockchain infrastructure. Likewise, GameSquare Holdings, a media firm listed on Nasdaq, has increased its digital asset authorization from $100 million to a whopping $250 million, holding 10,170 ETH and developing new strategies for NFT yield generation.

The trend doesn’t stop there; other notable firms like Intchains Group (7,023 ETH), KR1, Exodus, and BTC Digital cumulatively hold just over 10,000 ETH, maintaining stability amidst the fluctuating market conditions of 2025.

So why does this all matter? The growing presence of Ethereum in public company treasuries signals increasing confidence in its value proposition as both a utility and a store of value. As of July 2025, only twelve public companies reported Ethereum holdings, which collectively totals 1,002,666 ETH worth $3.70 billion. This may seem modest, accounting for just 0.83% of the total ETH supply, yet the momentum is unmistakable. Ethereum’s price has experienced volatility in recent months, rebounding from a dip below $1,383 in April to around $3,700 by late July. This resurgence has led to substantial unrealized gains for the top holders, with SharpLink enjoying a remarkable 29% increase and BitMine a 13.7% climb.

What does the future hold? While Ethereum’s penetration in corporate treasuries may still lag behind Bitcoin, its influence is undeniably expanding. As public companies increasingly acknowledge Ethereum’s potential, we can expect more companies to reassess their balance sheets, ultimately leading to a wider adoption of Ethereum in mainstream finance.

In conclusion, as Ethereum solidifies its position as a major player among treasury assets, both old and new organizations are strategizing around its value. How will your investment strategy adapt to this rapidly changing landscape? Staying informed is crucial—so keep your eyes peeled as these developments unfold!

For further insights into market trends and cryptocurrency developments, check out the latest analyses on

CoinDesk or follow the updates at CoinTelegraph.